Content

- Stand Out With Custom Invoices

- Taxes, Discounts, Shipping

- Recurring Billing For Repeat Customers

- Business Solutions

- How Does An Electronic Invoice Differ From A Paper

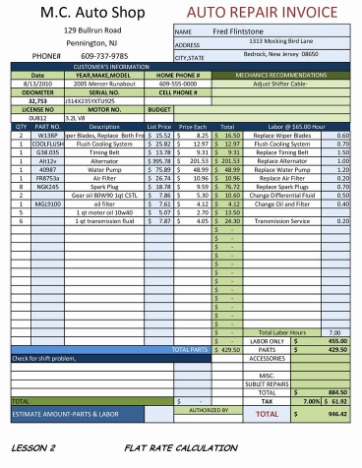

Keep in mind, however, that we looked at billing and invoicing apps, not time tracking or expense tracking software—each of which has a different target audience. This format is used for invoicing of work billed hourly and the parts. Enter hours and rate, and the formula calculates line total. Enter price and quantity, and the formula calculates line total. Perfect errorless calculations within seconds with this invoice template Excel. Enter the hours worked on project, the rate charged per hour, and the tax rate to be applied.In many industries, like freelance writing, for example, payment depends on the hiring company’s terms. Many companies adopt a net 30 or net 60 policy in which contractors are paid within 30 or 60 days of receipt of the invoice. Service and payment details like the ones mentioned above are listed below your and your client’s business information. They are often highlighted and appear at the center of the invoice for quick reading. Once you have found a suitable template and have correctly formatted your invoice, you can start entering your information. This will include the components mentioned earlier (business name, amount, payment details, etc.). It helps both the seller and the buyer to keep track of their payments and amounts owed.A recurring invoice is one generated on a cyclical basis during the lifetime of a rental contract. The same principle would be adopted if you were invoiced in advance, or if you were invoiced on a specific day of the month.

Stand Out With Custom Invoices

In Canada, the registration number for GST purposes must be furnished for all supplies over $30 made by a registered supplier in order to claim input tax-credits. You’ll always know who you need to communicate with and about what, so you can leave a great impression with customers. Over the past 10 years that we have used Zoho Invoice, I can’t remember a point where it has not worked. A commercial invoice is a document used for customs declaration in the sale of goods that are exported across international borders. Invoicing later evolved to hand-written invoices on animal skin, parchment, or paper. These invoices contained most of the elements of a modern invoice and used signatures or seals.

Is hand written bill allowed in GST?

You can have Handwritten GST number on invoice. Refer Rule 46 of CGST Rule read with Rule 48 of CGST Rule does not says that GSTIN Number should be preprinted on invoices.The basic invoice is useful for listing a description and an amount, and we have other designs for service providers that charge based on hourly rates. If your business sells and ships products, you may be more interested in our sales invoice template.

Taxes, Discounts, Shipping

VAT or GST, then the buyer and seller may need to adjust their tax accounts in accordance with tax legislation. A Self-Billing Agreement will usually provide for the supplier not to issue their own sales invoices as well. Different billing and invoicing software will offer you different options for how to bill your customers. Certain software will have premade templates on hand for you to fill in any necessary information to send to your customers. Other software may offer you the ability to fully customize your invoices with your logo, messaging and any other branding that relates to your business. If you are an independent contractor who uses service-based invoices frequently, make a list of suitable invoice templates for regular use.

Recurring Billing For Repeat Customers

Download the free service invoice template from FreshBooks to customize your invoices, save them and send them to clients for payment. The template is available in Microsoft Word, Excel and PDF format. For a long time it was common practice for freelancers to set a 30-day deadline for payment on invoices. But payment deadlines have shortened in recent years, with the rise of quick payment methods like online payments and recurring billing.

Business Solutions

We offer payroll services in Canada and the U.S. at a super affordable price. Most full-blown accounting systems and a number of billing systems have an “Order Entry of Sales” front end where you can key in the items or services for which you want to bill. For the most part, these items or services need to be defined before you can use the sales front end.

How long does a company have to invoice you for services?

The statute of limitations is 2 years for oral contracts and 4 years for written contracts.Set up recurring invoices and automatic credit card payments for your repeat customers and stop chasing payments. Switch between automatic and manual billing whenever you want. For example, if you are an accountant, look for invoice templates made for financial service providers. These may offer more suitable details and formatting features.

How Does An Electronic Invoice Differ From A Paper

Wave delivers an excellent, free accounting service for freelancers. Its invoice creation and management tools are good, too, though the invoices could stand to be more flexible. Yes, Square Invoices lets you send text or email receipts for every type of invoice, no matter the payment method. For recurring invoices, your customers will get a receipt for every payment from the first invoice to the final invoice. Only pay for processing when you accept debit and credit card payments and ACH bank transfer payments. Win more work with professional estimates and contracts, stay on track with reporting and cash flow management tools, and know your customers better with a Square Customer Directory.

- The cliché about the world not beating a path to your door seems to be doubly true when it’s regarding people who owe you money.

- Some companies accept invoices on submission/completion of work , while others may accept it before the work has even begun (doctors, lawyers, etc.).

- The Open Applications Group has a working relationship with UN/CEFACT where OAGi and its members participate in defining many of the Technology and Methodology specifications.

- Marketing banner on the bottom of the page can be used to advertise products and services.

- Being able to juggle tax information, create receipts, expense accounts, as well as automate follow-up notices, are valuable features for SMBs.

Quickly customize an invoice with important details like your company name, address, line items, taxes, totals, and terms. Provide customers with a seamless online payment experience. Customers can even use Apple Pay, Google Pay, or ACH bank transfers to settle invoices right from their phone. Let customers pay invoices online, in person, or from their phone with a credit card, Apple Pay, Google Pay, or ACH bank transfer.Your customers will be willing to pay you much quicker with how easy it is for them to pay. Payroll Pay employees and independent contractors, and handle taxes easily. Many business owners, sole proprietors, and freelancers use an invoice to request and receive payment for services rendered. This invoice is a professional document that service providers can send to their clients to bill them for the hours or projects worked. Sample billing invoice template in excel for hourly roofing work. Enter project description, service description, hours, tax rate, and hourly rate, and the template will calculate total due before and after tax.

Start Sending Free Invoices Today

It is not an actual invoice, and thus the seller does not record a pro forma invoice as an account receivable and the buyer does not record a pro forma invoice as an account payable. A pro forma invoice is not issued by the seller until the seller and buyer have agreed to the terms of the order.Fortunately, with the free service invoice template from FreshBooks, you can get paid what you are worth without spending a dime. Timesheet – Invoices for hourly services issued by businesses such as lawyers and consultants often pull data from a timesheet. A timesheet invoice may also be generated by Operated equipment rental companies where the invoice will be a combination of timesheet based charges and equipment rental charges. These may specify that the buyer has a maximum number of days in which to pay and is sometimes offered a discount if paid before the due date.