March 2, 2022 by Dick RiceYou'll start receiving the latest news, benefits, events, and programs related to AARP's mission to empower people to choose how they live as they age. You are leaving AARP.org and going to the website of our trusted provider. Please return to. Read more

March 2, 2022 by Dick RiceGiven that British citizenship can be passed down one generation under British law, any child of Harry's would therefore be eligible to qualify as British citizens, so barring any unforeseen legal maneuvers, Lilibet likely carries that status as well... Read more

March 2, 2022 by Dick RiceThis prevents the issuance of many fraudulent tax refunds. As of April 30, 2015, the IRS reported that it identified and confirmed 141,214 fraudulent tax returns and prevented the issuance of nearly $754.5 million in fraudulent tax refunds as a resul... Read more

March 1, 2022 by Dick RiceSee theDepartment of Statefor more information. An F-2 spouse can only study less than full time. Full-time enrollment requires a change of visa status to F-1.However, there is a limit to the amount we can pay your family. If any of. Read more

March 1, 2022 by Dick RiceTiming is based on an e-filed return with direct deposit to your Card Account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required.Basic. Read more

March 1, 2022 by Dick RiceMassachusetts has different income filing thresholds for residents versus nonresidents; non-resident thresholds are adjusted based on time spent in Massachusetts and are highly complex, much more so than for residents. But the legislation only applie... Read more

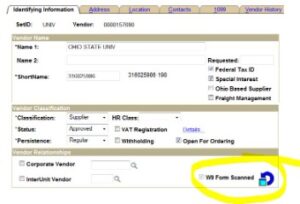

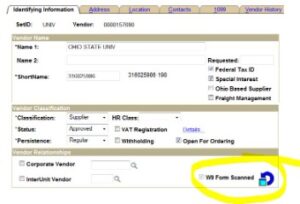

March 1, 2022 by Dick RiceSome vendors will fill out a form like one of the Form W-8 or similar forms for foreign persons. Form W9 is an Internal Revenue Service form for vendors to fill out and provide to the trades or businesses that pay. Read more

February 28, 2022 by Dick RiceYou can check the status of your refund and get a more exact date after that time by visiting the IRS website. As for your state tax return, you'll most likely have to report it, but you’ll want to check with. Read more

February 28, 2022 by Dick RiceThe due date for these 2022 payments are April 15, June 15, September 15, and January 16 . Almost everyone is required to file a personal tax return using Form 1040, and this includes business owners who run a pass-through business. Read more

February 28, 2022 by Dick RiceIf abuse is present, it changes how IRS will view other factors including the knowledge factors. The non-requesting spouse’s alcohol and drug abuse can be considered abuse of the requesting spouse. Abuse of the requesting spouse’s child i... Read more