When it comes to measuring the health of your accounts receivable, most businesses use the accounts receivable turnover ratio. Another metric to look at is the average collection period, which tells you how long it takes your clients to pay you. The longer your collection period, the worse your accounts receivable are. Accounts receivable are listed as a current asset on the balance sheet and are composed of money owed to you for your goods and/or services. Accounts receivable (AR) is a current asset account in which a business records the amounts it has a legal right to collect from customers who received services or goods on credit.

Accounts payable (AP), is the list of all amounts a company owes to its vendors. Generally, when an invoice is received, it’s recorded as a journal entry and posted to the general ledger. When the expense is approved by the authorized employee, a check is cut (digital or hard copy) based on the terms of the purchase agreement.

Accounts payable and accounts receivable are key to understanding the financial standing of your business. It is important to correctly classify where your expenses belong to gauge your business’s profitability. Businesses use accounts receivable to keep track of pending payments from customers.

If you consistently pay on time and are a reliable customer, a discount should be a no-brainer. When the amount of the credit sale is remitted, they will debit the liability in the AP ledger and will credit cash. The segregation of accounts payable and accounts receivable is important. Different people should execute these functions to ensure the risk of fraud is reduced. When Company ABC makes a payment to its vendor, the accounts payable account is debited.

Products

A company may establish many open accounts payable in the course of normal business operations. Examples include payments owed to marketers, caterers, product suppliers, accountants, and governments (in the form of taxes). Until the marketer’s bill is paid, the expense sits in accounts payable. Once the money actually gets paid out, company bookkeepers record the transaction on a cash flow statement. If the company is satisfied with the products and services, it’ll send an invoice within the agreed-upon payment period (e.g., net-30 or net-90). Accounts payable and accounts receivable are two sides of the same coin.

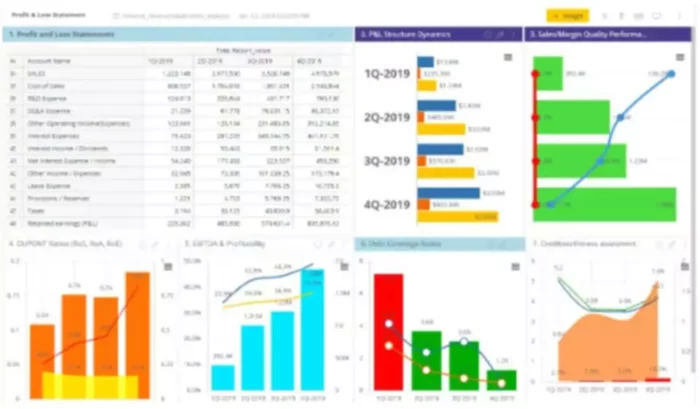

As an accountant, your clients depend on you to help manage their finances. Today, automation plays an important role in optimizing the accounts payable and accounts receivable processes. To gauge the profitability of your business, determine the total of your assets and accounts receivable. In contrast, a negative balance indicates that you need to rethink your current business model and limit expenses to avoid being in the red.

Common mistakes in cash flow statements

StyleVision’s bookkeeper creates an accounts payable journal entry and credits Frames Inc.’s account $500 by Sept. 15, then debits $500 from StyleVision’s inventory asset account. To optimize cash flow, you want to get paid as quickly as possible and take as long as you can to pay vendors. That is where accounts payable and accounts receivable discounts come in. Accounts receivable are the money customers owe you for your goods and services. They are recorded as a current asset on balance sheets and other accounting reports.

Accounts payable is the money owed to vendors and suppliers that results in cash outflow. Meanwhile, accounts receivable is the money you receive from selling goods and services that leads to revenue. Accounts payable and accounts receivable are often confused and understandably so as they both represent the funds going in and out of your business. In short, accounts payable is the money you owe, whereas accounts receivable is the money others owe you. We’ve prepared an in-depth guide to compare accounts payable vs. accounts receivable to help you gain a better understanding of these two bookkeeping basics. The goal is always to pay vendors as late as possible and on the best terms.

- These accounts are typically recurring and treated as a current liability on your balance sheet.

- She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University.

- You must be able to identify both processes to reduce stress in the long run.

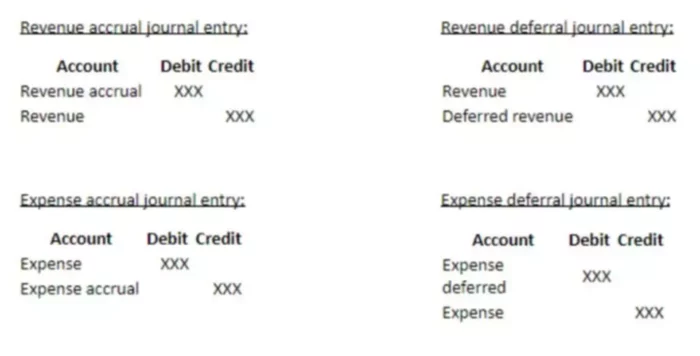

- Generally, when an invoice is received, it’s recorded as a journal entry and posted to the general ledger.

On the individual-transaction level, every invoice is payable to one party and receivable to another party. A key metric for finance teams to track is days payable outstanding (DPO). This shows the average number of days it takes your company to make payments to creditors and suppliers and indicates how well you’re managing both cash flow and supplier relationships.

Accounts payable and receivable track when you get paid and what you owe. Both are vital to effective cash flow management.

However, for large orders, a company may ask for a deposit up front, especially if the product is made to order. Services firms also frequently bill some portion of their fees up front. With the cash-basis accounting method, a company records expenses when it actually pays suppliers. StyleVision would record the $500 down-payment on the frames when it places and pays for the order, and then post the $500 balance when it receives the frames and issues that final payment.

A common example of an accounts receivable transaction is interest receivable, which you get from making investments or keeping money in an interest-bearing account. Similar to the above example, debiting the cash account by $250,000 also means an increase in cash account by the same amount. Additionally, crediting accounts receivable by $250,000 means a decrease in the accounts receivable by the same amount. Therefore, debiting accounts receivable $250,000 means an increase in accounts receivable by the same amount. Similarly, crediting the sales account by $250,000 means an increase in sales by the same amount.

Accounts Payable vs. Accounts Receivable

When auditors test AP, they typically look for instances of quantity errors or, in some cases, unethical behavior on the part of the vendor. For example, the supplier might have mistakenly, or purposely, billed for more products than it delivered. For every sale or purchase, your business will either issue or receive an invoice. If you’ve provided the good or service, the finance team will note the amount you expect to be paid in accounts receivable. If you are paying the invoice, you’ll note the amount in accounts payable. Once an authorized approver signs off on the expense and payment is issued per the terms of the contract, such as net-30 or net-60 days, the accounting team records the expense as paid.

Accounts receivable (AR) represents the money owed to a company for sales made on credit. Accounts receivable is part of the business life cycle between the delivery of goods or services and the payment for those by customers. They are considered assets on a balance sheet, with expected payments within a year. A company that keeps track of accounts payable will be able to determine where its money is going and how to be more cost-efficient. Meanwhile, a business that monitors its accounts receivable will be able to be up to date on its profitability and follow up on invoices past the due date.

If your AP increases or decreases, you’ll know it by looking at your accounts payable reports. Accounts payable are expenses incurred from buying from vendors and suppliers. If a company buys raw materials from a supplier, this results in an account payable for the company. When a customer pays for your service in installments, the amount owed will be listed as an account receivable until it is fully paid. A company’s accounts payables comprise amounts it owes to suppliers and other creditors — items or services purchased and invoiced for.

Income is important, and so is prudent spending to grow the business and retain customers. Mismanagement of either side of the equation can adversely affect your credit and, eventually, the stability of your business. Examples of accounts receivable include lawn care clients who pay at the end of every month or factories who pay after a piece of machinery is delivered. These notes are IOUs—they promise a certain amount of money that will be paid by an assigned date. Billing is part of accounts receivable and is defined as the process of generating and issuing invoices to customers.

This action violates multiple generally accepted accounting principles (GAAP) that guides corporate finance. Accounts receivable—but not accounts payable—sometimes involves a running balance called an offset allowance. The idea behind offset allowances is some accounts receivable balances may never be paid. Accountants call these “doubtful accounts.” An offset allowance is a sum of money the company stands to lose if doubtful accounts don’t pay their bills. The company will take a loss, and this will affect its overall bottom line. Accounts payable is a current asset account; it reports money that should soon flow into the company.

Beyond mere accounting procedures, accounts payable and accounts receivable are the means to understand the financial health of a business. When your clients have a solid handle on accounts payable, they will be able to establish where their money is going and decide how to be more efficient. Conversely, scrutinizing accounts receivable will help your clients understand their profitability and follow up to procure any late payments.

What Are Accounts Receivable?

Brolin said by requiring half the payment upfront, you reduce the likelihood you’ll be chasing money once the job is complete or the order is met. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. In the meantime, start building your store with a free 3-day trial of Shopify. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business. From a leadership perspective, these two functions need to remain strictly separate, in the hands of different departments or personnel. Manage your day-to-day activities with ease and have peace of mind that you have the right people working on the right task, at the right times.

What is the difference between accounts receivable and accounts payable?

Accounts receivable is a current liability account—it describes money that will soon leave the company. In a very small company with relatively straightforward transactions, a bookkeeper’s general ledger might be limited to transactions where cash has already changed hands. These companies use cash basis accounting, which only records cash transactions and does not delve into sales based on credit. Generally, it does not cover payroll and the overall cost of your long-term debt and mortgage—however, you should record monthly payments for debts in the accounts payable. Auditors use different methods to evaluate the efficacy of accounts payable and accounts receivable safeguards.