Content

- Dictionary Entries Near Account Receivable

- What Happens If Accounts Receivable Is Never Settled?

- What Is The Difference Between Receivables And Accounts Receivable?

- Why Is Accounts Receivable Important?

- Legal Definition Of Account Receivable

- Variability Of Asset Characteristics

- What Is The Accounts Receivable Turnover Ratio?

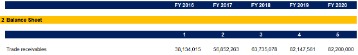

- Where Do I Find Accounts Receivable?

Please declare your traffic by updating your user agent to include company specific information. To allow for equitable access to all users, SEC reserves the right to limit requests originating from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic. If these notes are due for more than one year, in that particular case, it is referred to as a Non-Current Asset. Other than Trade Receivables, several different types of receivables need to be factored in.

- To improve your business’s liquidity, it pays to keep a close eye on your trade receivables.

- The change in the bad debt provision from year to year is posted to the bad debt expense account in the income statement.

- Other than Trade Receivables, several different types of receivables need to be factored in.

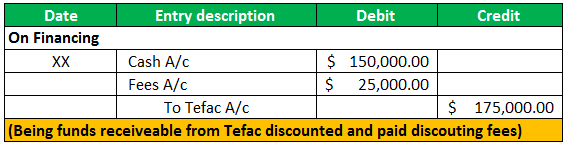

- In practice, the terms are often shown as two fractions, with the discount and the discount period comprising the first fraction and the letter ‘n’ and the payment due period comprising the second fraction.

- Put simply, trade receivables are the total amounts that a company has billed to a customer for goods and services that they have delivered but haven’t yet received payment for.

- The direct write-off method is not permissible under Generally Accepted Accounting Principles.

There is an allowance for this on the vendor’s balance sheet with a line amount called “Allowance For Doubtful Accounts”. Companies can calculate the amount a number of ways, but the amount is deducted from the accounts receivable total in the assets section of the balance sheet. Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company. The phrase refers to accounts a business has the right to receive because it has delivered a product or service. Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period.Often a company will take a week or two to get an invoice out after its product has been delivered or it has finished providing a service. When invoicing is delayed, payment is delayed, meaning the company can’t use those funds for something else. Accounts receivable are found on a firm’s balance sheet, and since they represent funds owed to the company they are booked as an asset. Companies can also receive early payment if their customers give them access to early payment programs such as supply chain finance or dynamic discounting.

Dictionary Entries Near Account Receivable

Current assets are a balance sheet item that represents the value of all assets that could reasonably be expected to be converted into cash within one year. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. However, the other side of this equation is the buyer, who may wish to extend payment terms in order to increase their Days Payable Outstanding .

What does an increase in receivables mean?

An increase in accounts receivable means that the customers purchasing on credit did not yet pay for all the credits sales the company reported on the income statement. Therefore, we subtract the increase in accounts receivable from the company’s net income.Accounts for notes receivable with interest and non-interest bearing notes. Trade Receivablesmeans the fair market value of goods and services to be received by the Company after the Closing under the Trade Agreements.

What Happens If Accounts Receivable Is Never Settled?

You might want to give them a call and talk to them about getting their payments back on track. Prepare entries for uncollectible accounts using the direct write off and allowance methods. Trade Receivablesmeans and refer to the Trade Accounts Receivable listed on Exhibit “EE” attached hereto and hereby made a part hereof, together with any and all other accounts receivable generated by the Business. In order to receive the payments within the time specified by the GOI, MSEs, if awarded with the contract, is/are mandatorily required to register themselves with the Trade Receivables Discounting System platform. This does not have to be a large amount, it can be 5% or a flat dollar figure, but if it’s a company that will be doing a lot of business with you, chances are they will appreciate it. Trade receivables on a balance sheet will be called “Account Receivables”.For example, interest revenue receivable and returns from any other sources of income that need to be received by the company are categorized as other receivable. However, other than that, it can be seen that there can be several other cases where other receivables might exist on the balance sheet of the company.

What Is The Difference Between Receivables And Accounts Receivable?

To illustrate, imagine Company A cleans Company B’s carpets and sends a bill for the services. Company B owes them money, so it records the invoice in its accounts payable column. Company A is waiting to receive the money, so it records the bill in its accounts receivable column. Accounts receivable is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. AR is any amount of money owed by customers for purchases made on credit. Current assets are assets which are expected to be converted to cash in the coming year.Deriving from the term ‘remit’ (meaning “to send back”), remittance refers to a sum of money that is sent back or transferred to another party. As you can see, it takes around 107 days for Company A to collect a typical invoice.

Why Is Accounts Receivable Important?

Accounts receivable is an important aspect of a businesses’ fundamental analysis. Accounts receivable is a current asset so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows.Any business that does not collect payment upon delivery, is essentially providing short term credit to their clients. If this is a problem for your small business, or if your larger products are an expense you can’t afford to wait for payment on, consider a new policy requiring a deposit upon ordering. This means before your business has done anything, part of the expense is already paid. Companies can achieve this in a number of different ways, including the use of receivables finance solutions. Factoring, for example, enables a company to sell its invoices to a factor at a discount, thereby receiving a percentage of the value of an invoice straight away. Trade receivables, or accounts receivable, are the opposite of accounts payable, which is the term used when a company owes money to its suppliers or other parties. Mostly this analysis is considered in terms of evaluating the context of turnover.Accounts receivable can make impact on liquidity of the company, thus it is important to pay attention to this metrics. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.Iconiq Capital led the $125 million round in HighRadius, which specializes in accounts receivable software… As mentioned earlier, it can be seen that Trade Receivables and Other Receivables are categorized as Current Assets in balance sheet. These are the amounts that are expected to be settled in less than 12 months. For example, you can immediately see that Keith’s Furniture Inc. is having problems paying its bills on time.

Legal Definition Of Account Receivable

Before deciding whether or not to hire a collector, contact the customer and give them one last chance to make their payment. Collection agencies often take a huge cut of the collectable amount—sometimes as much as 50 percent—and are usually only worth hiring to recover large unpaid bills. Coming to some kind of agreement with the customer is almost always the less time-consuming, less expensive option. Following up with late-paying customers can be stressful and time-consuming, but tackling the problem early can save you loads of trouble down the road. Instead, they maintain a file of the actual notes receivable and copies of notes payable. Trade Receivablesmeans amounts billed by Borrowers to their customers upon delivery of goods or services to such customers in the ordinary course of Borrowers’ business.

When To Call Something bad Debt

The direct write-off method is not permissible under Generally Accepted Accounting Principles. Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service. The strength of a company’s AR can be analyzed with the accounts receivable turnover ratio or days sales outstanding. An unsecured claim is a claim or debt for which the seller has no assurance of payment because there is no security.Trade receivables are current assets because they refer to monetary amounts owed to the business by customers that are collectable within two to three months from the sale date. Depending on business collection policies and payment structuring, a trade receivable may become due in as little as 10 days. Business fortunes can turn in as little as 30 days, and the seller could end up losing the money due on the trade receivable if the buyer’s business fails. If the seller of the goods or services fails to perform a credit evaluation of the buyer’s ability to make good on the trade receivable, the risk of an asset becoming a bad debt is possible. If the buyer declares bankruptcy, the trade receivables of the seller could become part of the bankruptcy proceedings.In these situations, the firm can obtain a short-term loan from a lender that uses the outstanding receivables as collateral. There are several variations on the concept, such as selling the receivables directly to the lender. These arrangements involve high interest charges and administrative fees, and so are not recommended unless lower-cost financing is not available.The ending balance on the trial balance sheet for accounts receivable is usually a debit. Put simply, trade receivables are the total amounts that a company has billed to a customer for goods and services that they have delivered but haven’t yet received payment for. These amounts are reflected in the invoices that a company sends to its clients. Trade receivables are likely to be one of the largest assets on your company’s books, aside from inventory.Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. Topics include the setup of new files, processing bank transactions, accounts receivable and accounts payable entries, reconciliation of bank and credit card accounts, and running basic financial reports. But if some of them are paying you late, or aren’t paying at all, selling to them could be hurting your business. Late payments from customers are one of the top reasons why companies get into cash flow problems. An example of a common payment term is Net 30 days, which means that payment is due at the end of 30 days from the date of invoice.