Content

- Choosing Cash Or Accrual Accounting

- Advantages Of Accrual Accounting +

- B2b, Cybersecurity, And The Relative Unimportance Of Business Valuation

- What Is The Accrual Basis Of Accounting?

- Accrual Vs Cash Basis Accounting: Whats The Difference?

- What Is Accrual Accounting?

As long as you’re getting that large bank reconciliation done and correctly, it should be correct. You may, for example, spend money on insurance and acquire a year’s worth of insurance coverage. In other words, when your check is cashed, and you spend money on something, it’s considered an expenditure for the cash-based accounting system. Cash flow is managed by checking accounts receivable against accounts payable.

Choosing Cash Or Accrual Accounting

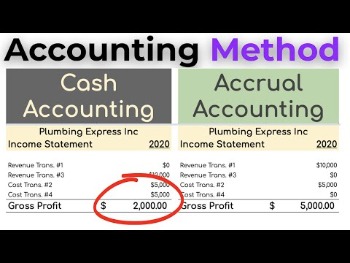

Even though the accrual method tends to be more popular among large businesses, it does have its drawbacks. Unlike the cash basis method, the accrual accounting method does not actively track your cash flow. While using the accrual method, it is imperative to have someone tracking the incoming revenue and outgoing expenses to understand the actual cash position of the business. Cash basis accounting is sometimes referred to as “bank balance” accounting. The main difference between accrual and cash basis accounting is the timing of when revenue and expenses are recorded and recognized. Cash basis method is more immediate in recognizing revenue and expenses, while the accrual basis method of accounting focuses on anticipated revenue and expenses. A disadvantage of accrual accounting is the additional bookkeeping.Running a successful business depends on a solid financial foundation. Continue reading to learn how selecting an entity structure can help build your financial foundation. For example, if your company appears to be cash-rich but has large amounts of account payables and has yet to pay them, your financial standing reflected in your bank accounts may look inappropriately good. In this case, investors might think your company is about to make a profit and continue growing but in reality, it may be losing money because of the unpaid accounts payable. If your business makes less than $25 million in sales a year and does not sell merchandise directly to consumers, the cash accounting method might be the best choice for you. In fact, it’s often the accounting method of choice for very small businesses, such as sole-proprietorships or partnerships.For example, let’s say in January you buy 1000 units from your wholesaler then sell those units over a year. The sale you made in August is now being linked back to your wholesale purchase in January to show the full circle of your cash flow and the transactions that affect it.This will make it more challenging to manage your cash flow because it will not be clear what’s coming in and going out over the next few days, weeks, or months. On top of that, dealing with your finances and accounting on your own can only add to the headache. At KPMG Spark, we want to help you simplify the process and we’ve put this guide together to help you better understand your accounting. Here, we’ll lay out the differences between the cash and accrual accounting methods and how to choose which is best for your business. The Generally Accepted Accounting Principles, or GAAP, are the standard framework of rules and guidelines that accountants must adhere to when preparing a business’s financial statements in the United States.

Advantages Of Accrual Accounting +

You could continue running your business in an unprofitable manner for at least another month — and possibly longer — on inaccurate assumptions made from your cash basis income statement. The reason some small business owners find the need to switch from cash to accrual is because of the benefits and accuracy the system provides. It gives you an exact layout and understanding of your company based on the transactions which are recorded immediately, even if there isn’t a settlement in cash. Having this understanding helps you assess your company’s performance and finances, and prepare for the future.

Why cash basis of accounting is not reliable?

The cash basis of accounting yields less accurate results than the accrual basis of accounting, since the timing of cash flows do not necessarily reflect the proper timing of changes in the financial condition of a business.For example, under the cash method, retailers would look extremely profitable in Q4 as consumers buy for the holiday season but would look unprofitable in Q1 as consumer spending declines following the holiday rush. The disadvantage of the accrual method is that it doesn’t track cash flow and, as a result, might not account for a company with a major cash shortage in the short term, despite looking profitable in the long term. Another disadvantage of the accrual method is that it can be more complicated to implement since it’s necessary to account for items like unearned revenueand prepaid expenses.

B2b, Cybersecurity, And The Relative Unimportance Of Business Valuation

Learn the differences between accrual vs. cash basis accounting and which method is better for your small business. While accrual accounting has its advantages, there are some drawbacks as well. Among the most commonly cited is its more complex method of bookkeeping and its inaccurate portrayal of a company’s short-term financial situation.

What Is The Accrual Basis Of Accounting?

Likewise, your records will recognize an expense only when your company hands over the cash to pay for it. Accrual can be more work because you have more lines to enter (ie. accounts receivable and accounts payable) and because you need to make sure those lines are posted in the correct period. Since you’re entering these extra lines, you’ll need to pay taxes on them even though you may have not yet received the income or paid for the expense. On a deeper level, accrual accounting allows you to match up revenue and its corresponding expense starting when the transaction occurs, rather than when payment is transferred. This method lets you understand the current cash flow and compare it to future cash flow . While tracking expenses and trying to determine net profit, the two accounting methods, cash v accrual, will yield different results.Under these guidelines, all companies with sales of over $25 million must use the accrual method when bookkeeping and reporting their financial performance. This means that if your business were to grow larger than $25 million in sales, you would need to update your accounting practices. If you think your business could exceed $25 million in sales in the near future, you might want to consider opting for the accrual accounting method when you’re setting up your accounting system.

Can a company switch from accrual to cash basis?

If you want to change from using the accrual accounting method to cash basis accounting, you will ordinarily need to request permission to do so by filing Form 3115 with the IRS.Then when subtracting cash receipts, modify the existing period’s earnings. Want to know if you should choose cash or accrual for your small business? Schedule a free call with one of our accounting experts to discuss the pros and cons for your business. In order to run a successful business, you need to have a solid financial foundation.

Accrual Vs Cash Basis Accounting: Whats The Difference?

They might end up having to pay taxes on this “imaginary profit” rather than the actual profit they’ll take home on the contract. Among the other advantages of using business accounting software, using an accounting software package can greatly simplify accrual accounting. Doesn’t track cash flow and as a result, might not account for a company with a major cash shortage in the short term, despite looking profitable in the long term.

- Both accrual and cash basis accounting methods have their advantages and disadvantages but neither shows the full picture about a company’s financial health.

- What isn’t obvious, however, is that July’s profit is actually from June’s activity and the type of work you’ve decided to no longer do.

- It can take considerable effort to accurately keep accrual basis books, especially when it comes to expense matching.

- Unless a statement of cash flow is included in the company’s financial statements, this approach does not reveal the company’s ability to generate cash.

- This lets your company keep more money in the business until a future tax period.

- This can provide you with a better overall understanding of consumer spending habits and allow you to plan better for peak months of operation.

Finally, within accrual accounting, contractors actually have additional options of when accrued income is recognized, each with their own implications. In the percentage-of-completion method, contractors bill for and recognize revenue periodically based on what proportion of the contract they’ve completed.

What Is Accrual Accounting?

And while it’s true that accrual accounting requires more work, technology can do most of the heavy lifting for you. You can set up accounting software to read your bills and enter the numbers straight into your expenses on an accrual basis. And if you run a hybrid accounting system, smart software will allow you to switch between cash basis and accrual basis whenever you need. In construction, businesses often have at least a little control over exactly when cash enters or leaves the company. For example, Built-It Construction might ask their customers to hold payment on December invoices until January, or they can pay early on expenses that aren’t due until January. As a result, they’re effectively deferring income into the next year.

Which Is Better For Your Business?

When you check out at the hardware store, you pay at the register. If you use a $20 bill or a debit card, you know it affects your money today. But if you pull out a credit card, it won’t impact your bank balance until you have to pay the Visa statement later. If you’re a small firm on cash-basis accounting right now and want to expand and get capital, you’ll need to switch to accrual-based financial reports. In the case of a cash basis, income is recorded as it becomes available. Rather than recording the income and expenditure, accrual-based accounting aims to quantify income and spending when incurred instead of when cash comes in, and money goes out. Cash basis accounting can show larger fluctuations because one month might be really profitable and the next is not because of the timing of receipts and money going out.