Content

- How To Calculate Inventory Costs

- Accountingtools

- Holding Costs

- How To Reduce Inventory Carrying Expense

- Which Industries Have The Highest Inventory Turnover?

- Definition Of ’inventory Cost’

- Use The Inventory Cost Formula

Common handling costs include material handling equipment, forklift truck drivers, and the people who manage your products. Even so, handling costs don’t just include wages — they also extend to any taxes applied by your government, employee benefits, and extra duty hours. For example, let’s say that the local Shopper’s Club Warehouse advertises a specific brand of television for a really good price.

- Inventory is a blanket term that is used to describe the goods that a business may sell.

- So, always keep in mind that your average carry cost of inventory should be within 15–30% of your total inventory value.

- In addition to the above 4 types of costs, there are opportunity costs, which are investments and improvements that you fail to make because your assets are tied up in inventory.

- Advanced software solutions are the answer to eliminating human errors and making sure your operations run as smoothly as possible.

- This in turn means that your business can be more efficient and streamlined.

- Finding an inventory storage solution that comes with fair holding costs is essential to your business’s long-term profitability, but the cheapest storage solution won’t always be the best for your business.

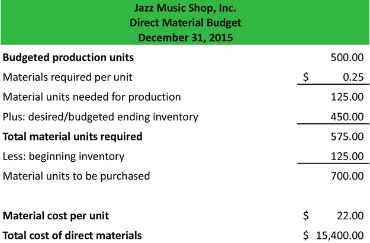

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Carrying costs are central for a “static” viewpoint on inventory, that is, when focusing on the impact of having more or less inventory, independently of the inventory flow. When you’re moving through inventory too slowly, promotions can help with that.Small businesses often incur obsolescence costs, though many of these can be avoided. Inventory cost includes the price a company pays to buy, store, and maintain items. Explore the definition, methods, and types of inventory cost, and learn about ordering, carrying, shortage costs, and the acronym COGS. Carrying costs, also known as holding costs and inventory carrying costs, are the costs a business pays for holding inventory in stock. Ordering costs are the costs that are incurred to prepare and process purchase orders and to receive and inspect merchandise that’s been ordered.

How To Calculate Inventory Costs

The tangible costs of storing inventory such as storage, handling, and insuring goods are obvious. Less obvious are the intangibles such as the opportunity cost of the money that was used to purchase the inventory, and the cost of deterioration and obsolescence of goods in storage. Other aspects of inventory risk include the possibility that the stored items may expire, especially with items that have a sell-by date or use-by date. If the items expire then they can become worthless and have to be scrapped. If a company stored parts for their work centers or equipment, but those parts were replaced with a new version, the parts in the warehouse could be worth far less than the price that was originally paid. In the retail industry, the risk is much higher as finished items may be seasonally specific. The storage space cost is a combination of the warehouse rent or mortgage, lighting, heating, air conditioning, plus the handling costs of moving the materials in and out of the warehouse.

Accountingtools

In addition, it’s easier to measure profit by item once you deduct that cost. The COVID-19 pandemic shows the importance of a just-in-time inventory strategy.

Holding Costs

Show bioRebekiah has taught college accounting and has a master’s in both management and business. When one has the proper information, inventory cost calculations can be very simple.

What are the relevant inventory costs?

Decisions about how much inventory to hold affect item costs, holding costs, ordering costs, and stockout (shortage) costs. …The pay that is received by the people that order inventory, deliver inventory, and receive and stock inventory is considered an ordering cost. If purchase orders are written up or printed, the cost of the purchase orders is also considered an ordering cost. If so, then you know how amazing it is to walk into this big building full of all sorts of items. I love going and buying things in bulk, and I’m always amazed at how much inventory there is stocked up on the shelves!

How To Reduce Inventory Carrying Expense

Based on inventory forecasting, you can purchase more strategically and have the basis to negotiate lower purchasing prices with suppliers to reduce the total inventory value. So this retailer’s carrying cost is 25% of their total inventory value. The cost of the goods sold is simply your total revenue minus your gross profits.Many local authorities tax the level of inventory in the warehouse, so higher levels of inventory will lead to higher taxes paid and a higher inventory service cost. Depreciation costs, also intangible, are the costs incurred as your inventory’s value naturally depreciates over time, and as products become progressively obsolete. Shrinkage, damaged or spoiled inventory, obsolescence, and opportunity costs. That being said, it can be argued that not all expenses are so easily reduced. Therefore, any reduction of the inventory value carries indeed great benefits.

Which Industries Have The Highest Inventory Turnover?

Based on the overall inventory needs, a company can can plan the cash flow cycles properly to avoid problems which may even cause the business to cease operations. This makes sense when one keeps in mind that perhaps the most common reason a business closes is lack of cash. Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time. Perishable or trendy inventory has a higher cost of obsolescence than non-perishable or staple items. Opportunity cost is generally defined as the price of foregoing other, possibly more advantageous uses for money that is being tied up in stored goods. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments.

What is inventory cost in supply chain?

Holding Cost The costs which is involved in holding this inventory are called Holding Costs.Carrying costs are the costs that are related to keeping inventory in stock. Shortage costs are the costs that a business incurs when they run out of stock. Knowing inventory costs is an essential part of knowing the total cost of goods sold. The cost of goods sold is the total dollar amount, including inventory costs, that a business paid for items sold. In order for a business to calculate how much money that it actually made from sales, the cost of goods sold is subtracted from the total sales to get the bottom line proceeds made from the sales of goods.Again, while there are a lot of common grounds in the literature, the categories and subcategories of inventory costs fluctuate and overlap, or are designated under different names. We don’t pretend to expose below the “right” typology, but simply one that hopefully can make sense and be useful for manager to get a full picture on inventory costs. Again, the ability to interpret specific business trends and market forecasts will improve your inventory turnover ratio. Therefore, you don’t have to keep obsolete inventory in the warehouse and reduce costs and space by checking inventory regularly. Software and management tools are pivotal for businesses who are looking to scale, since software automates your inventory and takes that hard work off your to-do list.There are many different things that need to be considered when you’re running your own business. For example, Stan is the warehouse manager for a distribution plant. His work has made him an expert in the science of managing inventory operations. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.The figure is used by businesses to determine how much income can be earned based on current inventory levels. It also helps a business determine if there is a need to produce more or less to maintain a favorable income stream. So they can accurately anticipate which inventory items they’ll need, when, and where, to help to minimize inventory holding costs. They need to calculate economic order quantity to lower holding costs in the future.Since the unit cost of inventory items will change over time, a company must select a cost flow assumption for removing the costs from inventory and sending them to the cost of goods sold. Modeling the cost of stock outs is in itself a vast topic that goes beyond the scope of this article. Let’s simply mention that basically the cost of inventory is counter-balanced by the opportunity cost of stock-outs. Balancing the cost of inventory with cost of stock-outs is typically achieved through the tuning of service levels. Then, it is neither always possible nor economical to keep track of all costs, or to split them and allocate them properly. For instance, at the time of combining the different costs, one needs to make sure that the elements are consistently expressed either as before-tax figures or after-tax and not a mix of the two.They cover essentially the risk that the items might fall in value over the period they are stored. This is especially relevant in the retail industry and with perishable goods. We routinely observe that a lot of companies don’t know exactly the full costs tied to their inventory. Worse, many companies rely on the false premise that regular accounting gives a reasonable estimate of the costs of their inventory. If you’re a Magento merchant looking for an inventory management solution, you can start with a free consultation with us. Together we’ll build a solution that fits your unique business requirements.

Tips To Reduce Carrying Costs

Using this historical data, businesses can adapt their pricing models and optimize their inventory costs, thanks to Skubana’s automatic updates on sales velocity, reorder quantities, and forecasted reorder dates. Making better cost decisions for your company is the surest way to improve your cashflow, experience a greater return on investment, and ultimately, continue to excel in your industry and scale to the next level. For instance, say I walked into the store and saw that they had grapes on sale for $1.69 a pound. When I go to look in the bin and get a nice bundle, I see that there are also containers of grapes that are discounted to $1 a pound. These are grapes that are older and not as pretty as the more expensive ones. If any of these grapes sell, then the company loses $0.69 a pound on them. If they don’t sell, then the company loses all the money that they spent purchasing the grapes as inventory.

Inventory Cost Definition

Alternatively, stockout costs can occur if a customer sees the product they want is out of stock on your website, so they end up purchasing it elsewhere. In order to optimize a company’s supply chain, a company needs to understand the total cost of its supply chain.Christopher S. Jones and Selale Tuzel, “Inventory Investment and the Cost of Capital”, January 2009, available online. Helen Richardson, “Control your costs then cut them”, Transportation & Distribution, December 1995, 94-96.