Content

- Work Anywhere With The Freshbooks Mobile App

- Invoicing Software And Time And Expense Tracking For Tax Businesses

- Save 538 Hours A Year

- Features Not Included In Quickbooks Self

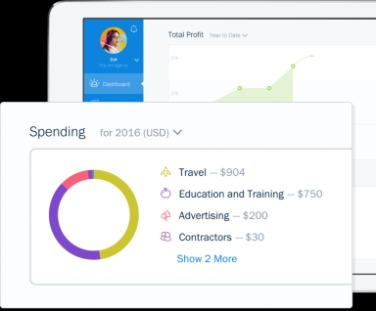

- Organize Expenses Effortlessly

- Accounting Features Designed For Business Owners And Accountants

The simplest option—and what most business owners choose—is the cash method. That means money gets recorded as you receive and pay it.

How much does FreshBooks cost per year?

The FreshBooks Lite Plan is priced at $15/month, or you can save by signing up for the annual plan for $180/year. One user is included in this price, although additional team members can be added for a fee. Features of the FreshBooks Lite Plan include: Unlimited invoicing for up to 5 clients.Look through your outstanding or overdue invoices and make sure they’re really outstanding. US – The IRS has a list of recommendations here (dependent on which forms you’re filing). In Canada you’re required to use the accrual method of accounting.

Work Anywhere With The Freshbooks Mobile App

Keep all your conversations, files and feedback in one place. You’ll keep your team in sync and your projects on schedule. The adjustments to income, also known as line deductions, help you lower your tax burden by reducing your total income. Our Customer Support Team is with you every step of the way.But if you are already working long hours on your business, you may want to focus your efforts on scaling instead of spending hours on tedious bookkeeping tasks. Instead, consider outsourcing as much or a little as you want to a bookkeeping service like Bench. When it comes to filing small business taxes for the first time, there are some things you’ll want to be aware of before you jump in. Business income reported on the K-1 is then used to complete the owner’s individual tax return and appears on Page 2 of Schedule E. Use our timer to accurately record hours spent per project. You’ll never be scrambling again to remember how many hours you worked for what client.

Invoicing Software And Time And Expense Tracking For Tax Businesses

They also want cloud-based software that allows for multiple users, lets them track billable hours and offers superior customer support. The software should be affordable, too and keep pace with them as their business grows. Keep a list of places that you should receive tax forms from and cross them off your list when you receive the form to stay organized.If so, you may need to issue a 1099-NEC (formerly this was reported on the 1099-MISC). There are several different types of 1099 forms and they are all labeled differently. Connect your account to get your receipts into FreshBooks. If you realize there was work you forgot to invoice for, or that you accepted payment for without generating an invoice, you can easily whip one up now. So whether you’ve prepared a lot or a little, here’s a step-by-step guide on how to use FreshBooks to give you confidence in your numbers this tax filing season. Reports in FreshBooks are simple enough for you to understand but powerful enough for your accountant to love.Bookkeepers need accounting software that let them manage their books, monitor expenses and master their invoicing system, all in one place. Tax businesses wantaccounting softwarethat can meet all their needs—from invoicing to double-entry bookkeeping. FreshBooks will automatically add the expense to your account. Email invoices to clients for free and accept payments online. Or print them off and mail them to clients who love snail mail.You and your team can log your hours and then automatically put them onto an invoice. Wow your clients with professional looking invoices that take only seconds to create.

Save 538 Hours A Year

Accounting software service geared towards, you guessed it, the self-employed, QuickBooks Online is generally more suited for larger companies. While this software does offer some features that can benefit the self-employed, there are some serious drawbacks as well. Let’s take a look at both the positive and negative aspects of QuickBooks Self-Employed along with how it compares to one of the best alternatives on the market – FreshBooks. Without it, we’d have to manually input expenses on a recurring basis. Come tax time, we no longer have to worry about inaccurately capturing expenses, which is a huge relief. FreshBooks Reports track everything year-round to make tax time easy.Stay on budget and know exactly how much you’re spending with easy-to-understand reports. Tax preparers needsmall business accounting softwarethat lets them track billable hours and send invoices quickly and easily. Before we jump into the details of how to file your small business taxes, it’s a good idea to understand just how small businesses are taxed. We’ll cover pass-through entities, which include sole proprietors, partnerships, limited liability companies , and S corporations.That’s because this tax is 15.3% of your taxable self-employment income. That combined with income taxes can make it feel like you’re paying a lot in taxes as a small business owner. Whether you plan on preparing your tax return solo or seeking professional help, there are some things you should know about filing business taxes for the first time. Powerful features let you request deposits, add discounts, set up payment schedules and even automate late payment reminders and fees.

Features Not Included In Quickbooks Self

That way, if you end up owing taxes, you will only have to pay the difference between what you owe and what you have already paid. Our support staff is with you on every step of your journey of growth, starting the moment you make the switch from spreadsheets or any other accounting software. With the FreshBooks mobile app you will easily stay connected with your clients and be able to take care of your accounting anywhere. Balancing your books, client relationships, and business isn’t easy. FreshBooks gives you the info and time you need to focus on your big picture—your business, team, and clients. One of the top features of QuickBooks Self-Employed is the OCR technology they use to automatically scan your receipts and input the data.Easily log and organize expenses in FreshBooks to track every dollar spent so you’re always ready for tax time. Bookkeeping is not just about entering invoices and paying bills. It might include processing payroll, reporting sales tax, reconciling bank statements, monitoring cash balances, tracking inventory, accounts receivable, and accounts payable. This guide will help you understand how business taxes work, so you can file your first business tax return with confidence. If you’re an employee who earned more than $600, you’ll get a W-2 from your employer. You will need one of these for each job you have worked in the tax year. It shows the wages you’ve earned and taxes you have paid over the taxable year.Businesses should keep copies of articles of incorporation to clarify how the business is structured. This section provides information about who’s filing the taxes, who’s covered in tax returns and how to deposit the refunds. A tax preparation checklist allows you to get organized and retrieve the necessary documents and information for compiling your tax return. Along with personal information, the checklist contains information about your income, adjustments to income, tax deductions and other information as required by the IRS. Invoicing with FreshBooks means every invoice and all tracked income is in one convenient place. So at tax time, you have a clear view of all invoices and line items from the previous year.

- Reports in FreshBooks are simple enough for you to understand but powerful enough for your accountant to love.

- As an employee, you pay half of the Social Security and Medicare taxes due, and your employer pays the other half.

- Either way, FreshBooks has beautiful templates that will make your billing shine.

- However, if you receive an unexpected form after you’ve filed, you will have to amend your return and that will cost you.

- FreshBooks helped tremendously with cash flow..We’ve collected on our accounts receivable at a higher percentage than we ever had before.

Whether it’s online payment, check, or e-transfer, make sure your invoice payment status is accurate at tax time. The tax reporting features allow users to pay estimated quarterly taxes and file federal and state income tax returns directly from the app. When you make estimated quarterly tax payments throughout the year, you aren’t stuck paying a hefty tax bill all at once when you file your taxes. But you’ll need to keep track of how much you paid in estimated taxes throughout the year and be sure to include the amount of taxes already paid on your tax return. Its fun and friendly interface will have you sending professional invoices and estimates, managing expenses and accepting credit card payments quickly and easily. It offers unlimited award-winning email and phone support, too. Manage yourtax business’s accountingon the go with the FreshBooks app.

Organize Expenses Effortlessly

This eliminates the need to manually input number sin an Excel spreadsheet. The software also has some bookkeeping capabilities, which can be beneficial to self-employed people.