Content

- Save Time And Money By Automating Invoice Processing

- How Does An Electronic Invoice Differ From A Paper

- How To Measure Your Accounts Payable Automation Roi

- Accounting Systems

- Cost To Process An Invoice

Receiving is required for all purchases in order to make sure that we are paying for what we ordered. For purchases under $10,000, receiving is automatically done in the system by “negative confirmation” — once PSDS receives an invoice, the department is notified to view the invoice information prior to payment.

What is difference between AR and AP?

What is accounts receivable and accounts payable? (with examples) … In other words, AR refers to the outstanding invoices your business has or the money your customers owe you, while AP refers to the outstanding bills your business has or the money you owe to others.The master vendor file is the repository of all significant information about the company’s suppliers. It is the reference point for accounts payable when it comes to paying invoices. When the invoice is received by the purchaser, it is matched to the packing slip and purchase order, and if all is in order, the invoice is paid. The three-way match can slow down the payment process, so the method may be modified. For example, three-way matching may be limited solely to large-value invoices, or the matching is automatically approved if the received quantity is within a certain percentage of the amount authorized in the purchase order.Many companies are involved in work to streamline or automate the business process of their accounts payable departments. This process is straightforward but can become very cumbersome, especially if the company has a very large number of invoices. This problem is compounded when invoices that require processing are on paper. This can lead to lost invoices, human error during data entry, and invoice duplicates. These and other problems lead to a high cost per invoice metric. The goal of automating the accounts payable department is to streamline this invoicing process, eliminate potential human error, and lower the cost per invoice. The supplier or vendor will send an invoice to the company that had received the goods and/or services on credit.

Save Time And Money By Automating Invoice Processing

Automated invoice processing software is akin to AP Automation. Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. These solutions usually involve a third party company that provides and supports an application which allows a supplier to submit an electronic invoice to their customer for immediate routing, approval, and payment.This is done to assure that a duplicate payment will not occur. Yes, Square Invoices offers integrations to the most popular accounting software providers, including QuickBooks Online and Xero. With Square, you’re able to seamlessly import payments processed with Square Invoices to your accounting software for accurate recordkeeping. You can accept all types of payment methods, like cards, cash, checks, and gift cards.

How Does An Electronic Invoice Differ From A Paper

While others are ripe for automation like data capture and approval workflows. Inc.com recommends choosing payment terms by considering your industry’s standards, as well as what will ensure a steady cash flow. Offering discounts for early payment appeals to some customers, for example, although some companies like to hold on to their money as long as possible before paying. After the receiving report and purchase order information are reconciled, they need to be compared to the vendor invoice. Hence, the receiving report is the second of the three documents in the three-way match . A receiving report is a company’s documentation of the goods it has received.Store and manage key customer details with a free Customer Directory. A role required to allow reporting from Business Intelligence Applications, Business Intelligence Publisher, Real Time Decisions, Enterprise Performance Management and Business Intelligence Office. This role allow you to run reports from the web catalog but it will not allow a report to be authored from a subject area. An author of Business Intelligence reports as presented in the web catalog. The role allows authoring within Business Intelligence Applications, Business Intelligence Publisher, Real Time Decisions, Enterprise Performance Management and Business Intelligence Office.

How To Measure Your Accounts Payable Automation Roi

He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem. Customers should know what the terms are before they make a purchase. It’s best to have terms in writing, such as on your company’s website, on signs in offices or retail stores, in promotional materials, and on all contracts.

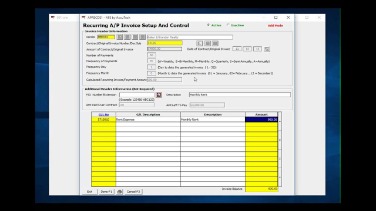

Accounting Systems

With one lower-cost platform that automates manual tasks, you can rest assured that invoices will be paid in a timely and accurate manner and costs will remain low. Since the mid 1960s companies have begun to establish data links between their trading partners to transfer documents, such as invoices and purchase orders. Inspired by the idea of a paperless office and more reliable transfer of data, they developed the first EDI systems.Issuing wire transfers when payment can not be made with the T&E Card or any other standard University form of payment. Link and sync corporate cards to get real-time visibility on your spend.

Cost To Process An Invoice

That means more late payments, high processing costs, missed pre-payment discounts, and many more issues. A manual invoice process, such as creating invoices on Microsoft Word or Microsoft Excel, can be time consuming and difficult to manage. E-invoicing lets your business automate invoice processing and save time by tracking key invoice data like open invoices . It also helps you manage late payments more efficiently with payment reminders you can send your customers before an invoice due date. As companies advance into the digital era, more and more are switching to electronic invoicing services to automate their accounts payable departments. Some even believe it to be an industry standard in the near future. According to a report done by the GXS team in 2013, Europe is adopting government legislation encouraging businesses to adopt electronic invoicing practices.Auditors often focus on the existence of approved invoices, expense reports, and other supporting documentation to support checks that were cut. The presence of a confirmation or statement from the supplier is reasonable proof of the existence of the account. It is not uncommon for some of this documentation to be lost or misfiled by the time the audit rolls around. An auditor may decide to expand the sample size in such situations. AP automation is the key to streamlining your invoice workflows while increasing the accuracy of your work.

- Effective automation functions include freeform recognition and automatic learning capabilities.

- The departmental preparer can view and reply to the queue message in BruinBuy.

- Have you ever had that terrible feeling that you’ve already received an approval for a bill but just can’t seem to find the proof?

- Send unlimited invoices, estimates, contracts, and more for free.

- Make the right impression with professionally designed custom invoices.

- This role allow you to run reports from the web catalog but it will not allow a report to be authored from a subject area.

Now that you know the real costs that go into paying invoices, you can take steps to reduce them. Physical goods include the fees paid to purchase paper, envelopes, ink cartridges, and stamps to print and mail checks. And don’t forget about the cost of the printer and printer maintenance.

Processing Payments On Invoice Payment Forms

The payment procedures vary depending on the method used to purchase. This information is an overview of accounts payable for our internal UVA customers. To ensure timely and accurate payment, vendors must follow the invoicing requirements below. If a document is received and does not comply with the stated requirements, it will be rejected and returned for re-issue. We’re transforming accounting by automating Accounts Payable and B2B Payments for mid-sized companies. Transaction fees could be scaled down by evaluating each payment method and determining which vendors accept lower-cost forms of payment that can potentially earn you cash-back rebates, like virtual cards. Regardless of where your business lands, going through this exercise gives you an opportunity to make informed decisions.

Manage Non

Accounts payable is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents. Processing an invoice includes recording important data from the invoice and inputting it into the company’s financial, or bookkeeping, system. After this is accomplished, the invoices must go through the company’s respective business process in order to be paid.