As you keep tabs on prepaid expenses, you’ll need to ensure all records are accurate when it comes to the financial close. An automation solution like SolveXia can help to execute your balance sheet reconciliations for you, in a fraction of the time, while minimizing error. The prepaid expense appears in the current assets section of the balance sheet until full consumption (i.e. the realization of benefits by the customer). If a company decides to pay for a product or service in advance, the upfront payment is recorded as a “Prepaid Expense” in the current assets section of the balance sheet.

A prepaid expense is an expense that has been paid for in advance but not yet incurred. In business, a prepaid expense is recorded as an asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. The adjusting journal entry is done each month, and at the end of the year, when the insurance policy has no future economic benefits, the prepaid insurance balance would be 0. A legalretainer is often required before a lawyer or firm will begin representation. When a company pays a retainer, it is recorded as a prepaid expense on the balance sheet.

Global E-Invoicing and Payment Software

As a reminder, the main types of accounts are assets, expenses, liabilities, equity, and revenue. By the end of the twelve-month coverage period, the entire insurance benefits are delivered, the total expenditure was expensed, and the corresponding asset on the balance sheet declines to zero. Once the benefits of the assets are gradually realized, the current asset is reduced as the asset is expensed on the income statement.

Examples of prepaid expenses include prepaid rent, insurance premiums, and annual subscriptions. Prepaid expenses are considered assets on a company’s balance sheet until they are used or expire. For example, assume ABC Company purchases insurance for the upcoming 12 month period. ABC Company will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense. In the 12th month, the final $10,000 will be fully expensed and the prepaid account will be zero.

Definition of Prepaid Expense: Examples & Tips

These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months). Once expenses incur, the prepaid asset account is reduced, and an entry is made to the expense account on the income statement. Sometimes, businesses prepay expenses because they can receive a discount for prepayment. Prepaid expenses may also provide a benefit to a business by relieving the obligation of payment for future accounting periods.

It includes insurance, rent, subscription, and utility bill payments. Prepaid expenses offer tax benefits as well as help you hedge against inflation. Prepaid expenses also help make sure that you do not miss services/goods such as insurance and supplies when needed. As the benefits of the prepaid expenses are availed over time, they are recorded in the income statement. Prepaid expenses are assets that can be found in a balance sheet that can be extracted from advance payments received from goods and services to be offered by a business in the future.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Stay up to date on the latest corporate and high-level product developments at BlackLine. Go beyond with end-to-end transformation.Powerful technology is only part of the story.

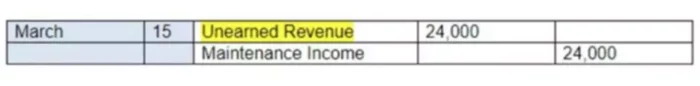

This journal entry credits the prepaid asset account on the balance sheet, such as Prepaid Insurance, and debits an expense account on the income statement, such as Insurance Expense. Prepaid expenses are future expenses that are paid in advance, such as rent or insurance. On the balance sheet, prepaid expenses are first recorded as an asset.

Expense method

While the concept of a prepaid expense is pretty easy to understand, the accounting that comes along with it is a bit more multi-faceted. We’ll shortly touch on how prepaid expenses start as an asset and then transform into an expense in due time. However, if the connection between the upfront payments and operating expenses (SG&A) is unclear, the projection of the prepaid expense amount can be linked to revenue growth as a simplification. In a financial model, a company’s prepaid expense line item is typically modeled to be tied to its operating expenses, or SG&A expense.

Despite the “expense” in the name, the company receives positive economic benefits from the expense over the course of several periods, hence its classification as a current asset. Also, an already used portion of the prepaid expense increases the expense amount entry and decreases the total prepaid asset value. As the benefits of the prepaid expense are realized, it is recognized on the income statement.

Free Up Time and Reduce Errors

BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations. In the coming twelve months, the company recognizes an expense of $2,000/month — which causes the current asset recorded on the balance sheet to decrease by $2,000 per month.

- Eventually, it will need to be recorded as an expense, when the benefits of the assets are realized.

- The prepaids concept is not used under the cash basis of accounting, which is commonly used by smaller organizations.

- To respond and lead amid supply chain challenges demands on accounting teams in manufacturing companies are higher than ever.

- Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company.

- Because the expense expires as you use it, you can’t expense the entire value of the item immediately.

Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. As you use the prepaid item, decrease your Prepaid Expense account and increase your actual Expense account. To do this, debit your Expense account and credit your Prepaid Expense account.

While the responsibility to maintain compliance stretches across the organization, F&A has a critical role in ensuring compliance with financial rules and regulations. Together with expanding roles, new expectations from stakeholders, and evolving regulatory requirements, these demands can place unsustainable strain on finance and accounting functions. BlackLine’s foundation for modern accounting creates a streamlined and automated close.

Any time you pay for something before using it, you must recognize it through prepaid expenses accounting. Do you ever pay for business goods and services before you use them? If so, these types of purchases require special attention in your books. At the end of the period, when all the benefits of the prepaid expense have been used, then the balance is reduced to zero.

ESG is an opportunity for F&A teams to have a direct impact on how their organizations interact with the communities around them and how they deliver value to their stakeholders. Unlock capacity and strengthen resilience by automating accounting. Continuously monitor for risk with automated fluctuation analysis. Create, review, and approve journals, then electronically certify, post them to and store them with all supporting documentation.