Using basic information about your annuity, an annuity table can help you find out the present value of your annuity. Once you have this information you can make more informed decisions about your finances because you’ll know exactly how much your annuity is worth in current dollars, given an assumed discount rate. The factor is determined by the interest rate (r in the formula) and the number of periods in which payments will be made (n in the formula). In an annuity table, the number of periods is commonly depicted down the left column.

- Calculating the present value of an annuity can help you determine whether a lump sum payment or future annuity payments spread out over years will be more beneficial to your financial needs or goals.

- They lay the calculations for predetermined numbers of periodic payments against various annuity rates in a table format.

- Find out how an annuity can offer you guaranteed monthly income throughout your retirement.

- At the end of the 10-year period, the $10,000 lump sum would be worth more than the sum of the annual payments, even if invested at the same interest rate.

Jim has run his own advisory firm and taught courses on financial planning at DePaul University and William Rainey Harper Community College. Figuring the present value of any future amount of an annuity may also be performed using a financial calculator or software built for such a purpose. The company can help you find the right insurance agent for your unique financial objectives. As required by the new California Consumer Privacy Act (CCPA), you may record your preference to view or remove your personal information by completing the form below.

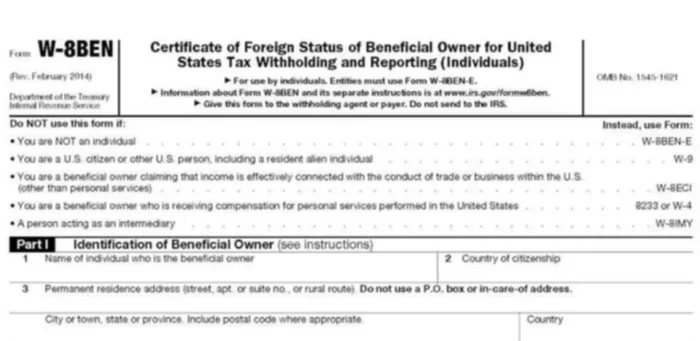

Annuity Table for an Ordinary Annuity

Annuities can help you plan for your retirement by providing a guaranteed source of income for you and your family when you reach your golden years. They aren’t the simplest of investments, though, and sometimes it can be difficult to know exactly how much your annuity is worth. An annuity table can help with that by allowing you to easily calculate the present value of your annuity. This information allows you to make informed decisions about what steps to take to plan for your retirement. If you need assistance with annuities or retirement planning more generally, find a financial advisor to work with using SmartAsset’s free financial advisor matching service.

Annuity due payments typically apply to expenses such as rent or car leases where payments are made on the first of the month. There is a separate table for the present value of an annuity due, and it will give you the correct factor based on the second formula. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

Present value of an ordinary annuity table

More commonly, annuities are a type of investment used to provide individuals with a steady income in retirement. Annuity tables are visual tools that use a formula to apply a discount rate to future payments. They lay the calculations for predetermined numbers of periodic payments against various annuity rates in a table format. Remember that all annuity tables contain the same PVIFA factor for a given number of periods at a given rate, just like all times tables contain the same product for any two given numbers. Any variations you find among present value tables for ordinary annuities are due to rounding. An annuity table provides a factor, based on time, and a discount rate (interest rate) by which an annuity payment can be multiplied to determine its present value.

Get personal finance tips, expert advice and trending money topics in our free weekly newsletter. For example, using Excel, you can find the present value of an annuity with values that fall outside the range of those included in an annuity table. You might want to calculate the present value of the annuity, to see how much it is worth today. The interest rate can be based on the current amount being obtained through other investments, the corporate cost of capital, or some other measure. Jim Barnash is a Certified Financial Planner with more than four decades of experience.

Present Value of an Annuity Table

Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy. This example is an easy calculation because we’re dealing with simple round numbers and only one payment period. But when you’re calculating multiple payments over time, it can get a bit more complicated. An annuity table, or present value table, is simply a tool to help you calculate the present value of your annuity. First, you need to know whether you receive your payments at the end of the period — as is the case with an ordinary annuity — or at the beginning of the period. When payments are distributed at the beginning of a period, the annuity is referred to as an annuity due.

- If you take a look at a variety of ordinary annuity tables, you’ll see the factors are all within a decimal place, depending on whether they are rounded.

- Lottery winners, for instance, often have to make a decision about whether to take a lump sum payment or take their money in the form of an annuity.

- Depending upon the numbers you’re working with and how accurate you want to be, an annuity table is a simple and convenient way to calculate the present value of an ordinary annuity.

- Therefore, if you consult an annuity table, you can easily find the PVIFA by identifying the intersection of the number of payments (n) on the vertical axis and the interest rate (r) on the horizontal axis.

- So, essentially, the $1,000 I give you 365 days from now is worth only $990 to you because you’ve missed the opportunity to invest it and earn the 1 percent compound interest.

- This information allows you to make informed decisions about what steps to take to plan for your retirement.

Simply select the correct interest rate and number of periods to find your factor in the intersecting cell. That factor is then multiplied by the dollar amount of the annuity payment to arrive at the present value of the ordinary annuity. A lottery winner could use an annuity table to determine whether it makes more financial sense to take his lottery winnings as a lump-sum payment today or as a series of payments over many years.

Annuity.org Announces Upcoming Retirement Webinar

The table considers how much money you have put into the annuity and how long it has been invested. Depending upon the numbers you’re working with and how accurate you want to be, an annuity table is a simple and convenient way to calculate the present value of an ordinary annuity. The formula for finding the present value of an ordinary annuity is often presented one of two ways, where “r” represents the interest rate and “n” represents the number of periods. The time value of money states that a dollar today is worth more than it will be at any point in the future. It makes sense when you consider that every dollar has earning potential because it can be invested with the expectation of a return. So, if you have $1,000 right now, and you put it in a high-yield savings account with a 1 percent annual percentage yield (APY), at the end of a year, you will have $1,010.

For example, an annuity table could be used to calculate the present value of an annuity that paid $10,000 a year for 15 years if the interest rate is expected to be 3%. An annuity table is a tool for determining the present value of an annuity or other structured series of payments. According to the concept of the time value of money, receiving a lump sum payment in the present is worth more than receiving the same sum in the future. As such, having $10,000 today is better than being given $1,000 per year for the next 10 years because the sum could be invested and earn interest over that decade. At the end of the 10-year period, the $10,000 lump sum would be worth more than the sum of the annual payments, even if invested at the same interest rate.

If you’re interested in buying an annuity, a representative will provide you with a free, no-obligation quote. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism. These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Because most fixed annuity contracts distribute payments at the end of the period, we’ve used ordinary annuity present value calculations for our examples. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. An annuity is a series of payments that occur at the same intervals and in the same amounts. An example of an annuity is a series of payments from the buyer of an asset to the seller, where the buyer promises to make a series of regular payments.

In the PVOA formula, the present value interest factor of an annuity is the part of the equation that is written as and multiplied by the payment amount. Therefore, if you consult an annuity table, you can easily find the PVIFA by identifying the intersection of the number of payments (n) on the vertical axis and the interest rate (r) on the horizontal axis. As discussed above, an annuity table helps you determine the present value of an annuity. Once you’ve found that number, you can make more informed investment decisions to build the best possible retirement portfolio for you.

The present value of your annuity is a component of your net worth, and you need this information to ensure a comprehensive picture of your finances. Different types of annuities (variable annuities, for instance) will have different tables. Talk to your advisor or annuity company to make sure you are using the correct table. Find out how an annuity can offer you guaranteed monthly income throughout your retirement.

What Is the Difference Between an Ordinary Annuity and an Annuity Due?

You can then look up the present value interest factor in the table and use this value as a factor in calculating the present value of an annuity, series of payments. Just as you regularly review your credit card statements, bank balances and investments, you’ll want to know the value of your annuity at any given point in time. As any expert in financial literacy will attest, your balance sheet is the foundation for everything from your budget to your retirement savings. There are many reasons you might want to know the present value of your annuity. Chief among them is the ability to tailor your financial plan to your current financial status.

A present value annuity table allows you to estimate the present value of an annuity quickly. Present value refers to the current value of future payments from an annuity with a specified rate of return. Although annuity tables are not as precise as annuity calculators or spreadsheets, the benefit of using an annuity table is the ease of calculating the present value of your annuity. Based on the time value of money, the present value of your annuity is not equal to the accumulated value of the contract.