Content

- Survey: More Than Half Of American Workers Say Theyre Behind On Retirement Savings

- Types Of Iras

- Compare Accounts

- Qualified Retirement Plans Vs Nonqualified Retirement Plans

- Things You Must Do If You Hope To Retire At Age 62

Usually, purchases of this stock are funded by employer contributions made to the plan based on total employee compensation. On leaving the firm through separation or retirement, the participant will receive all vested interests in the form of the actual shares in the account. Alternatively, he or she may demand a cash distribution in lieu of the shares. While technically a defined benefit plan, a cash balance plan is actually a hybrid plan.

- This may influence which products we write about and where and how the product appears on a page.

- Bankrate.com does not include all companies or all available products.

- The money from your employer match may be required to vest, potentially for years, before it becomes entirely yours.

- As one of the largest qualified retirement plan platforms in the country, we offer many plan design options to help create a plan that meets anyone’s needs.

- This limit is $20,500 in 2022; $19,500 in 2021 and 2020 and $19,000 in 2019, subject to cost-of-living adjustments in later years.

- In other words, the employee will pay taxes on the funds before they are contributed to the plan.

The plan benefits at least 70 percent of employees who are not highly compensated employees . If your plan is a 401 plan or contains a 401 cash or deferred arrangement , does it comply with the requirements of 401? Check that your 401 plan complies with section 401, including the Actual Deferral Percentage test and the distribution requirements. Loans from some plans must meet certain requirements and require the participant to apply.Check that, other than for participant loans permitted under the terms of your plan, no benefits under the plan were used as collateral for a loan or otherwise assigned or alienated. At a minimum, the distributions must be evenly spread over the life of the employee or over the lives of the employee and a designated beneficiary . If your plan provides for elective deferrals, does it limit those deferrals to the section 402 limit? Check that in operation, elective deferrals made for each employee are limited to the section 402 limit. Nondiscrimination—Benefits must be proportionately equal in assignment to all participants to prevent excessive weighting in favor of higher-paid employees.

Survey: More Than Half Of American Workers Say Theyre Behind On Retirement Savings

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Vesting—After a specified duration of employment, a participant’s right to a pension is a nonforfeitable benefit.

Types Of Iras

Employer contributions made to a qualified retirement plan on behalf of their employees are tax-deductible. If you’re a sole proprietor, you can deduct the amount you contribute for yourself; it depends on the type of plan. Employers can deduct up to 25% of the compensation paid to eligible employees for a defined contribution plan. But the deduction for contributions to a defined benefit plan requires an actuary to calculate your deduction limit. While technically a defined contribution plan, a target benefit plan is actually a hybrid plan.Roth 401 contributions don’t offer any immediate tax break; contributions are made with after-tax money. Qualified plans can take the form of defined-contribution or defined-benefit plans and can run the gamut from 401 plans to pension plans.

Compare Accounts

Roth vs. traditional IRA comparisonthat the Roth is a better choice for most eligible retirement savers. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Contribution limits are subject to cost-of-living adjustments; this means they may increase in the future. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance. Note that this policy may change as the SEC manages SEC.gov to ensure that the website performs efficiently and remains available to all users.The plan document must state that the Actual Deferral Percentage test of Code section 401 will be satisfied and must actually satisfy the test in operation. Additionally, the law has changed to allow an employer not to perform an ADP test if it makes a safe harbor contribution to the plan on behalf of employees.

Qualified Retirement Plans Vs Nonqualified Retirement Plans

At retirement, defined contribution plan benefits are typically paid in installments or as a lump sum; however, they may also be paid as an annuity. Your plan document describes who is covered under your plan, i.e., who benefits under your plan, and what contributions or benefits will be provided to those covered employees. Your employees’ rights to contributions and benefits are derived from the plan document. Even if the terms of your plan do not reflect your intent, you must follow the terms of your plan. But see item 3, below, with respect to the prohibition against cutting back benefits that your employees have already accrued under the plan. Nonqualified plans are often offered to key executives and other select employees.

Is an individual IRA a qualified retirement plan?

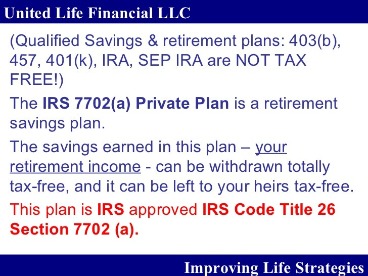

A qualified retirement plan is an investment plan offered by an employer that qualifies for tax breaks under the Internal Revenue Service (IRS) and ERISA guidelines. … A traditional or Roth IRA is thus not technically a qualified plan, although these feature many of the same tax benefits for retirement savers.There are other employer-sponsored retirement plans that do not qualify under the ERISA. In general, they are based on deferred income in some way; they are also most often aimed at executives. A qualified plan is established by an employer to provide retirement benefits for its employees and their beneficiaries.

Things You Must Do If You Hope To Retire At Age 62

Deferred compensation may come from the executive’s income, such as bonus income, set aside for the future. It may also be funded by the employer funding the executive’s future retirement benefits.

What is qualified tax status?

These terms refer to a retirement plan’s tax status. A qualified retirement plan is funded with pre-tax money, essentially reducing the taxable income of the account holder by the amount of their contributions for the year. … Funds in qualified plans are taxable as ordinary income when they are withdrawn.If you don’t have a financial advisor yet, finding one doesn’t have to be difficult. This free tool allows you to get personalized recommendations for financial advisors in your area in just minutes. Benefits typically are not payable until normal retirement age and usually are paid in the form of a lifetime annuity.There are more restrictions to a qualified plan, such as limited deferral amounts and employer contribution amounts. Consider talking to your financial advisor about qualified retirement plans and where they fit into your overall financial planning strategy.401 Plan Fees Disclosure Tool – Model comparative chart for disclosures to participants of performance and fee information to help them compare plan investment options. SEP Retirement Plans for Small Businesses – Describes an easy, low-cost retirement plan option for employers. Choosing a Retirement Solutions for Your Small Business – Provides information about retirement plan options for small businesses. Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments. If there were any distributions made, were participants given the right to a direct rollover? Check that for distributions from your plan eligible to be rolled over to another plan, the distributee was given the option to have the distribution transferred directly to the other plan. The date 6 months after the date on which the employee satisfied the minimum age and service requirements.