Content

- When Should Invoices Be Issued?

- Stone Invoices

- Examples Of ‘invoice’ In A Sentence

- What Is An Invoice And How Does Invoicing Work?

- Tips For Writing Invoices

- In Other Projects

Customer information also goes at the top of your invoice and reflects the format of your company information. Include customer’s name, billing address, shipping address , phone number, and email address. This also means you can track and adjust your inventory to improve cash flow and avoid overstocking or running out of a popular product. You should have records of all your invoices in one, organized location. This is crucial not only for bookkeeping and tax purposes but also for staying on top of things. With Square Invoices, everything is stored right in your Dashboard and sorted by status. A customer, you send or give them a bill for goods or services that you have provided them with.

- The total due is the full amount owed by the customer, including applicable sales tax and any other charges.

- A pro forma invoice is a document that states the commitment of the seller to deliver goods and services to the buyer for an agreed-upon price.

- It details what goods have been provided, or what work has been done, and how much must be paid in return.

- This is the main part of your invoice as it makes up the total amount due and indicates the products your customer ordered from you.

- If the invoice amount is right and the correct goods or services have been received, the person will sign off on it.

When you own your own business, you need to keep meticulous records of all cash in and out—which includes copies of all invoices. Pro forma invoice – In foreign trade, a pro forma invoice is a document that states a commitment from the seller to provide specified goods to the buyer at specific prices. It is not an actual invoice, and thus the seller does not record a pro forma invoice as an account receivable and the buyer does not record a pro forma invoice as an account payable. A pro forma invoice is not issued by the seller until the seller and buyer have agreed to the terms of the order. In a few cases, a pro forma invoice is issued to request advance payments from the buyer, either to allow production to start or for security of the goods produced.

When Should Invoices Be Issued?

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.The payee uses data in the packing slip to apply for the payments. For all GST purposes, a seller must issue a tax invoice to the buyer regardless of whether the sale involves cash or credit.

Stone Invoices

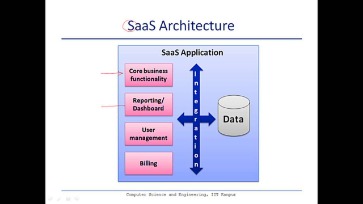

The word “Invoice” and the company logo must be prominent on the document so that they can be identified easily. The most important benefit of an invoice is the ability to keep a legal record of the sale. This makes it possible to find out when a good was sold, who bought it, and who sold it. Specialized SaaS companies ensure that invoicing is now automated, secure, and instant, so you can invoice on the move.

Examples Of ‘invoice’ In A Sentence

Include details about the method of shipping, expected delivery date, and tracking information. Spending time up front to implement a scalable invoicing workflow can save you time and money in the long run. It is one of naivety – that somehow the education will arrive without an invoice to pay.The EDIFACT is followed up in the UN/CEFACT ebXML syntax cross industry invoice. Statement – A periodic customer statement includes opening balance, invoices, payments, credit memos, debit memos, and ending balance for the customer’s account during a specified period. A monthly statement can be used as a summary invoice to request a single payment for accrued monthly charges.

What Is An Invoice And How Does Invoicing Work?

Since many of the smaller stores do not keep sales records that are as detailed as big stores, lightbulb manufacturers had the option to invoice SDG&E using shipment data instead of sales data. The order gets processed, an invoice is generated, the client pays and the product is delivered to the client. Venable lawyers listed 12-hour workdays on the case 16 times, according to the invoice. Your customer makes the payment in full, and you reconcile the invoice after receiving this payment, to complete the transaction. Upon receiving the invoice, your customer has a period of time in which they’ve legally agreed to pay you by . An invoice due date is the date upon which full payment of the invoice total is due. If this date passes and the full amount hasn’t been paid, the invoice is considered overdue.It’s also common for larger businesses to strong arm smaller suppliers into lengthy payment terms that disproportionately suit them, to the smaller business’ detriment. Invoicing software ensures that payments are absolutely secure with PCI DSS compliance. You can even automatically collect payments on a recurring basis. The client’s contact info must also be included to ensure legality of the document.Find a free invoice template that’s right for your business on our free invoice templates resource page. Pro forma invoices are issued to a customer before a product or service is delivered. Businesses use pro forma invoices to help customers understand the scope and cost of an upcoming project. Pro forma invoices are sent before a formal invoive is issued to give customers an estimate of how much a product or service will cost once delivered. The terms in a pro forma invoice may need to be adjusted as a project progresses, but they can be a helpful tool to ensure businesses and customers are on the same page before work begins. An invoice is a document or bill sent by a provider of goods and services to their customer. Invoices itemize the transaction and include payment amounts and terms.

Tips For Writing Invoices

A debit invoice is issued when a business needs to increase the amount a client owes for a service or product. Evaluated receipt settlement – ERS is a process of paying for goods and services from a packing slip rather than from a separate invoice document.

What Happens When A Customer Refuses To Pay An Invoice?

Commercial invoices are customs documents used when a person or business is exporting goods internationally. The information included in commercial invoices is used to calculate tariffs. Different types of invoices can be issued to customers depending on the purpose of the invoice. Here are a few of the most common types of invoices you may use during the payment process.

In Other Projects

A Self-Billing Agreement will usually provide for the supplier not to issue their own sales invoices as well. Modern-day invoices are transmitted electronically, rather than being paper-based. If an invoice is lost, the buyer may request a copy from the seller. The use of an invoice represents the presence of credit, as the seller has sent a product or provided a service without receiving cash up front. Square Invoices features a professional-looking template in which you can fill in all the pertinent information related to the project or job.