Content

- Keeping Accurate Books

- What Is Double Entry Bookkeeping And How’s It Fit In General Ledger?

- How To Use Double Entry Accounting

- Double Entry

- Compare Accounting Software

- Proper Training Allows For Accurate Record

Common stock is part of stockholders’ equity, which is on the right side of the accounting equation. As a result, it should have a credit balance, and to increase its balance the account needs to be credited. It can take some time to wrap your head around debits, credits, and how each kind of business transaction affects each account and financial statement.When choosing accounting software, companies should look for features such as real-time data access, advanced analytics tools and accelerated closing processes. This entry puts an account receivable on the books by debiting the asset and records revenue earned with a credit. The third financial statement that Joe needs to understand is the Statement of Cash Flows. This statement shows how Direct Delivery’s cash amount has changed during the time interval shown in the heading of the statement.

- Essentially, the representation equates all uses of capital to all sources of capital (where debt capital leads to liabilities and equity capital leads to shareholders’ equity).

- The first transaction that Joe will record for his company is his personal investment of $20,000 in exchange for 5,000 shares of Direct Delivery’s common stock.

- It’s impossible to find investors or get a loan without accurate financial statements, and it’s impossible to produce accurate financial statements without using double-entry accounting.

- On the next line, the account to be credited is indented and the amount appears further to the right than the debit amount shown in the line above.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. The emergence of double-entry has been linked to the birth of capitalism. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Keeping Accurate Books

Most asset and expense accounts are increased with a debit entry, while most liability and revenue accounts are increased with a credit entry. Even if you use accounting software, there could be errors recorded in your bookkeeping. Sometimes, automated bank feeds either miss transactions or duplicate them. To prevent this from happening, you should complete a process called account reconciliation on a regular basis to keep your books accurate. That means you match every transaction in your accounting software to its corresponding bank statement. The two rules of this type of accounting are every transaction must be recorded in two or more accounts, and the total amount debited needs to equal the total amount credited. Double-entry accounting is a method for booking journal entries to reflect financial activity by updating two or more accounts with equal and opposite debits and credits.

What is dual effect?

The dual effect principle is the foundation or basic principle of accounting. It provides the very basis for recording business transactions into the records of a business. This concept states that every transaction has a dual or double effect and should therefore be recorded in two places.He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Double-entry provides a more complete, three-dimensional view of your finances than the single-entry method ever could.Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. A second popular mnemonic is DEA-LER, where DEA represents Dividend,Expenses,Assets for Debit increases, and Liabilities,Equity,Revenue for Credit increases. In pre-modern Europe, double-entry bookkeeping had theological and cosmological connotations, recalling “both the scales of justice and the symmetry of God’s world”. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.As a company’s business grows, the likelihood of clerical errors increases. Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. Increase a liability or equity account, or decrease an asset account. Here, the asset account – Furniture or Equipment – would be debited, while the Cash account would be credited. It is important to note that after the transaction, the debit amount is exactly equal to the credit amount, $5,000. Double-entry bookkeeping has been in use for at least hundreds, if not thousands, of years. Accounting has played a fundamental role in business, and thus in society, for centuries due to the necessity of recording transactions between parties.

What Is Double Entry Bookkeeping And How’s It Fit In General Ledger?

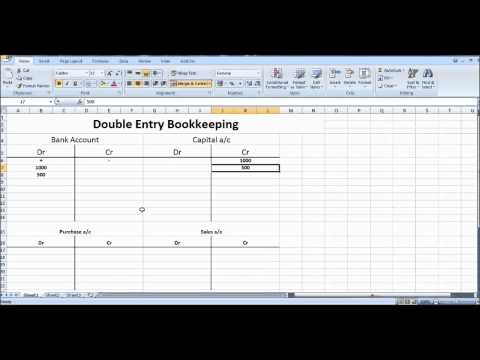

You can also divide the major accounts in accounting into different sub-accounts. For example, you might use Petty Cash, Payroll Expense, and Inventory accounts to further organize your accounting records. Single-entry accounting is less complex than double-entry accounting. With the single-entry system, you record cash disbursements and cash receipts. A T-account is an informal term for a set of financial records that uses double-entry bookkeeping.

How To Use Double Entry Accounting

Joe can tailor his chart of accounts so that it best sorts and reports the transactions of his business. Finally, if you’re replaying a loan to the bank, you’ll decrease the cash you have on hand while also decreasing the liability of the loan. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. This practice ensures that the accounting equation always remains balanced – that is, the left side value of the equation will always match with the right side value.

Double Entry

Joe will be able to see at a glance the cash generated and used by his company’s operating activities, its investing activities, and its financing activities. Much of the information on this financial statement will come from Direct Delivery’s balance sheets and income statements. The accounting equation defines a company’s total assets as the sum of its liabilities and shareholders’ equity.A detailed explanation of the transaction is posted below each journal entry. Credits increase balances in liability accounts, revenue accounts, and capital accounts, and decrease balances in asset accounts and expense accounts. Debits are recorded on the left side of a ledger account, a.k.a. T account. Debits increase balances in asset accounts and expense accounts and decrease balances in liability accounts, revenue accounts, and capital accounts. As a result, few companies today use manual recording methods for double-entry bookkeeping. At a minimum, modern bookkeeping relies on spreadsheets that can automate some calculations.

Compare Accounting Software

The system is designed to keep accounts in balance, reduce the possibility of error, and help you produce accurate financial statements. It’s impossible to find investors or get a loan without accurate financial statements, and it’s impossible to produce accurate financial statements without using double-entry accounting. While you can certainly create a chart of accounts manually, accounting software applications typically do this for you. Once you have your chart of accounts in place, you can start using double-entry accounting.Accountants call this the accounting equation, and it’s the foundation of double-entry accounting. If at any point this equation is out of balance, that means the bookkeeper has made a mistake somewhere along the way. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

Proper Training Allows For Accurate Record

All U.S. public companies must be GAAP compliant for financial reporting purposes. Additionally, most lenders require GAAP-compliant financial statements when evaluating loan applications from any private or public company. Marilyn points back to the basic accounting equation and tells Joe that if he memorizes this simple equation, it will be easier to understand the debits and credits. In this example, you’re going to make a debit entry to the Machinery account – assets that increase get a debit entry – and a credit entry to the Cash account – assets that decrease get a credit entry.The company should debit $5,000 from the Wood-Inventory account and credit $5,000 to the Cash account. So to put it simply, double-entry bookkeeping allows you to keep more diligent, accurate records.

The Basics Of Double Entry

Essentially, the representation equates all uses of capital to all sources of capital (where debt capital leads to liabilities and equity capital leads to shareholders’ equity). For a company keeping accurate accounts, every single business transaction will be represented in at least of its two accounts. Bookkeeping and accounting are ways of measuring, recording, and communicating a firm’s financial information. A business transaction is an economic event that is recorded for accounting/bookkeeping purposes. In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses. Single-entry accounting involves writing down all of your business’s transactions (revenues, expenses, payroll, etc.) in a single ledger. If you’re a freelancer or sole proprietor, you might already be using this system right now.