Content

- See For Yourself How Easy Our Accounting Software Is To Use!

- How Do You Record Retained Earnings?

- Is Retained Earnings On The Income Statement?

- What Is The Difference Between Compound Growth, Exponential Growth & Simple Growth?

- How To Calculate Dividends Paid To Stockholders With Retained Earnings

- What Is A Real Retained Earnings Example?

- What Does It Mean For A Company To Have High Retained Earnings?

This allocation does not impact the overall size of the company’s balance sheet, but it does decrease the value of stocks per share. The formula used to calculate retained earnings is equal to the prior period retained earnings balance plus net income. And from that figure, the issuance of dividends to equity shareholders is subtracted. At the end of every accounting period , you’ll carry over some information on your income statement to your balance sheet. The beginning period retained earnings appear on the previous year’s balance sheet under the shareholder’s equity section. The beginning period retained earnings are thus the retained earnings of the previous year.

- Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs.

- But, instead of withdrawing the funds, they’re retaining the money to reinvest in the business or save to pay future dividends.

- Such a balance can be both positive or negative, depending on the net profit or losses made by the company over the years and the amount of dividend paid.

- Finally, provide the year for which such a statement is being prepared in the third line .

- Your retained earnings account on January 1, 2020 will read $0, because you have no earnings to retain.

Retained earnings can be used for a variety of purposes and are derived from a company’s net income. Any time a company has net income, the retained earnings account will increase, while a net loss will decrease the amount of retained earnings.

See For Yourself How Easy Our Accounting Software Is To Use!

You can use retained earnings to fund working capital, to pay off debt or to buy assets such as equipment or real estate. Traders who look for short-term gains may also prefer dividend payments that offer instant gains. Profits give a lot of room to the business owner or the company management to use the surplus money earned. This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes. In other words, money in the retained earnings account serves as a business cash reserve or working capital. And by calculating retained earnings over time, you can get a sense of your business’s profitability.The earnings can be used to repay any outstanding loan the business may owe. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. You may decide to purchase equipment or hire more employees, which empowers you to take on more higher-paying jobs.By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called theretention ratio and is equal to (1 – the dividend payout ratio). The statement of retained earnings is a financial statement entirely devoted to calculating your retained earnings. Like the retained earnings formula, the statement of retained earnings lists beginning retained earnings, net income or loss, dividends paid, and the final retained earnings. Because all profits and losses flow through retained earnings, essentially any activity on the income statement will impact the net income portion of the retained earnings formula.In addition to retained earnings, company leaders can monitor the business’ growth in profit per share and overall stock price over specific periods of time. If they see progressive increases, the company’s current state of reinvesting retained earnings is considered effective. If not, it’s time to reevaluate what’s being done with retained earnings. Retained earnings are listed on a company’s balance sheet under the equity section.

How Do You Record Retained Earnings?

These reduce the size of a company’s balance sheet and asset value as the company no longer owns part of its liquid assets. Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity.

Is Retained Earnings On The Income Statement?

For example, during the period between September 2016 and September 2020, Apple Inc.’s stock price rose from $28.18 to $112.28 per share. The ability to do both showed that Apple was in a strong place financially and using its profits well. Apple Inc., which makes consumer electronics, computers, and other products, had retained earnings of $45.9 billion as of September 28, 2019.Revenue sits at the top of theincome statementand is often referred to as the top-line number when describing a company’s financial performance. The income money can be distributed among the business owners in the form of dividends. A growth-focused company may not pay dividends at all or pay very small amounts because it may prefer to use the retained earnings to finance expansion activities. Your retained earnings balance is $105,000, and you can decide if you want to reinvest that money and/or pay off debts with it. Companies in a growth phase tend to reinvest more of their surplus into the business, whereas a mature company may opt to pay more dividends when it has a surplus. Along with some other financial measures, this can show whether management has been using the retained earnings well.Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. For our retained earnings modeling exercise, the following assumptions will be used for our hypothetical company as of the last twelve months , or Year 0. In other words, cash from operations is sufficient to fund reinvestment needs.The effect of cash and stock dividends on the retained earnings has been explained in the sections below. You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings.

What Is The Difference Between Compound Growth, Exponential Growth & Simple Growth?

For those recording accounting transactions in manual ledgers, you should be sure closing entries have been completed in order to properly calculate retained earnings. Those using accounting software will have their retained earnings balance calculated without the need for additional journal entries. The prior period retained earnings balance can be found on the beginning of period balance sheet, whereas the net income is linked from the current period income statement. There may be multiple viewpoints on whether to focus on retained earnings or dividends. However, knowing how much retained earnings a company has, how much they would increase dividend payments, and the potential impact of reinvestment will give business owners an informed perspective. So, no, retained earnings are not considered an asset on a balance sheet.

How To Calculate Dividends Paid To Stockholders With Retained Earnings

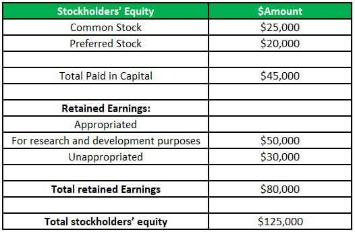

A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years. Instead, they reallocate a portion of the RE to common stock and additional paid-in capital accounts.Such items include sales revenue, cost of goods sold , depreciation, and necessaryoperating expenses. During the same period, the total earnings per share was $13.61, while the total dividend paid out by the company was $3.38 per share. As an investor, one would like to know much more—such as the returns the retained earnings have generated and if they were better than any alternative investments. Additionally, investors may prefer to see larger dividends rather than significant annual increases to retained earnings. Revenue is the money generated by a company during a period but before operating expenses and overhead costs are deducted. In some industries, revenue is calledgross salesbecause the gross figure is calculated before any deductions.If, say, the business has $250,000 in assets and $125,000 in liabilities, the shareholders’ equity is $125,000. For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight. Observing it over a period of time only indicates the trend of how much money a company is adding to retained earnings. Deciding how to invest net income is an essential task for any small business owner and retained earnings can tell you how much you’re working with before you make any major investments. Or you can use retained earnings to pay off debts and take that stress off your shoulders.Thus, retained earnings balance as of December 31, 2018, would be the beginning period retained earnings for the year 2019. Typically, businesses record their retained earnings on a balance sheet.If a company puts all of its earnings back into itself but doesn’t show high growth, stockholders might be better served if the board of directors declared a dividend instead. If the company faces a net loss then the net loss will be subtracted from the beginning retained earnings amount. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. Get instant access to video lessons taught by experienced investment bankers.Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. With that said, a high-growth company with minimal free cash flow will conversely re-invest toward extending its growth trajectory (e.g. research & development, capital expenditures). Higher retained earnings mean increased net earnings and fewer distributions to shareholders . We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep.That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Get clear, concise answers to common business and software questions.Retained earnings are a type of equity and are therefore reported in the shareholders’ equity section of the balance sheet. Although retained earnings are not themselves an asset, they can be used to purchase assets such as inventory, equipment, or other investments. Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future or offer increased dividend payments to its shareholders. The figure is calculated at the end of each accounting period (monthly/quarterly/annually). As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term. The resultant number may either be positive or negative, depending upon the net income or loss generated by the company over time.

Free Accounting Courses

A balance sheet is a financial statement made up of total assets, liabilities and owner’s equity. Assets are the items of value that you own; liabilities are what you owe; and equity is the money you have left after paying down debts. Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial statements. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance.

What Does It Mean For A Company To Have High Retained Earnings?

You have beginning retained earnings of $4,000 and a net loss of $12,000. Retained earnings are business profits that can be used for investing or paying down business debts. They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners. Retained earnings are also known as retained capital or accumulated earnings. When you own a small business, it’s important to have extra cash on hand to use for investing or paying your liabilities.That is the amount of residual net income that is not distributed as dividends but is reinvested or ‘ploughed back’ into the company. At the end of the period, you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period, adding any net income or net loss, and subtracting any dividends. In the long run, such initiatives may lead to better returns for the company shareholders instead of those gained from dividend payouts.