Content

- Are Social Security Benefits Taxable After Age 62?

- Federal Return

- Gross Income Vs Combined Income

- Tax Services

- How Is Social Security Taxed?

- How Is Adjusted Gross Income Agi Calculated?

This Google™ translation feature, provided on the Franchise Tax Board website, is for general information only. Consult with a translator for official business. New Golden State Stimulus II information now available. COVID-19 updates for California taxpayers affected by the pandemic. Distributions from non-Roth IRAs and qualified retirement plans are generally fully taxable unless nondeductible contributions have been made. Bank products and services are offered by MetaBank®, N.A.

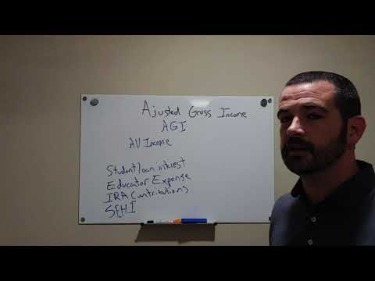

What is counted in adjusted gross income?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. … Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account.They don’t include supplemental security income payments, which aren’t taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Returnor Form 1040-SR, U.S.

Are Social Security Benefits Taxable After Age 62?

If the child is married, see Publication 915, Social Security and Equivalent Railroad Retirement Benefits for the applicable base amount and the other rules that apply to married individuals receiving social security benefits. By limiting distributions, and thus taxable income, during retirement, QLACs can help minimize the tax bite taken from your Social Security benefits. Under the current rules, an individual can spend 25% or $135,000 of a retirement savings account or IRA to buy a QLAC with a single premium. The longer an individual lives, the longer the QLAC pays out. To provide a consistent basis for comparing income over time, MINT projects the amounts that will define the income-quartile boundaries among beneficiary families from 2010 to 2050, and expresses them relative to the national AWI . For example, among beneficiary families in 2010, a family with total income equal to at least 2.273 times the national AWI was in the fourth income quartile.

Federal Return

Fees apply if you have us file a corrected or amended return. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.. When your employer pays you wages, they are required withhold a portion of your paycheck for Social Security and Medicare taxes. It sometimes happens that an employer might not withhold enough of these taxes. If this happens, you might have to pay these taxes when you file your return.

- MetaBank® does not charge a fee for this service; please see your bank for details on its fees.

- Available only at participating H&R Block offices.

- By using these distributions to boost your income when you’re retired or nearing retirement, you might be able to delay applying for Social Security benefits.

- And, you might talk to a financial planner about a retirement annuity.

- Earned income does not include investment income, pension payments, government retirement income, military pension payments, or similar types of “unearned” income.

- You are leaving AARP.org and going to the website of our trusted provider.

Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. A payroll deduction plan is when an employer withholds money from an employee’s paycheck, most commonly for employee benefits and taxes. Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits. This advantage makes it wise to consider a mix of regular and Roth retirement accounts well before retirement age.

Gross Income Vs Combined Income

Learn about property classifications and get tax answers at H&R Block. Small Business Small business tax prep File yourself or with a small business certified tax professional. Finances Emerald Advance Access to a line of credit, with no W-2 required to apply. State taxes Social Security Benefits but offers exemptions for things like Age and Income. You can also manage your communication preferences by updating your account at anytime. You will be asked to register or log in. All of the child’s other income, including tax-exempt interest.Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations. What if I receive another tax form after I’ve filed my return?

Tax Services

For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits. The IRS has an online tool that calculates how much of your benefit income is taxable. If you’re married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn’t receive any benefits, you must add your spouse’s income to yours when figuring on a joint return if any of your benefits are taxable. The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages,self-employed earnings, interest, dividends,required minimum distributions from qualified retirement accounts, and any other taxable income. Projecting taxation over a period of decades requires certain assumptions about future tax policy.She received her LEED accreditation from the U.S. Green Building Council in 2008 and is in the process of working towards an Architectural Hardware Consultant certification from the Door and Hardware Institute. She received a bachelor’s degree in economics and management from Goucher College in Towson, Maryland. “Which states tax Social Security benefits?” Accessed Nov. 24, 2020. Melissa Horton is a financial literacy professional.

How Is Social Security Taxed?

MINT excludes beneficiaries born before 1926, child beneficiaries, disabled beneficiaries younger than age 31, and beneficiaries who reside in nursing homes. For beneficiary families that must pay income tax on their benefits, MINT projects that the mean percentage of benefit income owed as income tax will increase from 11.7 percent in 2010 to 11.9 percent in 2015 and to 12.2 percent in 2030. By 2050, MINT projects that families that owe any tax on their benefits will owe 14.7 percent of their benefits as income tax on average.

Does Social Security look at adjusted gross income?

We base Social Security benefits on your lifetime earnings. We adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Then, Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.Most state programs available in January; release dates vary by state. Learn more about the capital gains tax exemption on the sale of a home with the experts at H&R Block. Wave self-serve accounting Financial software designed for small businesses. Emerald Card The best in digital banking, with a prepaid debit card. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely.If you’re filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your MAGI. It can also be a baseline for determining the phaseout level of some credits and tax-saving strategies, and sometimes the formula for MAGI can depend on the type of tax benefit it applies to.The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. This may not be a realistic goal for everyone, but there are ways to limit the taxes you owe. Up to 85% of Social Security benefits are taxable for an individual with a combined gross income of at least $34,000, or a couple filing jointly with a combined gross income of at least $44,000. 14 Means tests limit eligibility for government-provided benefits or reduce the amount of the benefit for individuals who have income or assets above thresholds set in law. Temporary Assistance for Needy Families , the Supplemental Nutrition Assistance Program , Supplemental Security Income , and Medical Assistance are means-tested programs. Social Security and Medicare, as social insurance programs funded largely by payroll taxes levied on workers and their employers, are not means tested, although Medicare Part B and Part D both charge income-related premiums to participants.