Content

- Report Interest Income To Irs, Even If It’s Just 50 Cents

- Small Business

- How Is Interest Income Taxed?

- Interest Is Taxed At Ordinary Income Tax Rates

- What Is Tax

- What’s Not Taxable

The most common way to earn interest that is tax-exempt at the state and local levels in addition to the federal level is for an investor to purchase a municipal bond issued in his or her state or locality of residence. Learn about Fidelity’s offering of bond funds that typically pay interest free from federal income tax. See “Nominees” in the Instructions for Schedule B for how to report the interest on your income tax return. Box 8 relates to interest-bearing investments you hold with state and local governments, such as municipal bonds.

How do I know if my interest is taxable?

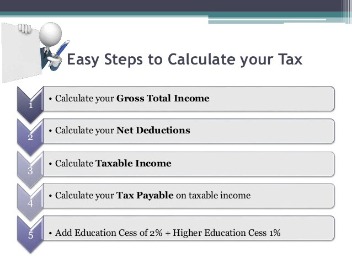

Where is taxable interest income reported on the tax return? If you received more than $1,500 of taxable interest or dividends during the year, you report all of that interest and dividend income on Schedule B attached to your Form 1040.Interest which accrues after the date of purchase, however, is taxable interest income for the year in which received or accrued . Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.. If a refund is indicated you will have received a corresponding check. A credit is an overpayment, which is applied to another tax period.The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. You do not need to report interest earned on tax-deferred accounts, such as Traditional IRAs or 401s, until you withdraw the earnings. Distributions from money market funds are typically reported as dividends, not interest. Yes, you must report all such distributions, including non-cash distributions, on Page 2, Line 2 of the New Hampshire I&D Tax return. If any part of a distribution is not subject to tax, you would deduct the appropriate amount on Page 2, Line 4. There is an exemption for income of $2,400.

Report Interest Income To Irs, Even If It’s Just 50 Cents

Interest on insurance dividends or increased value in prepaid insurance premiums you withdraw. Investment expenses appear in Box 5. Most people can no longer deduct investment expenses since the Tax Cuts & Jobs Act of 2017 eliminated the ability to deduct these for the 2018 through 2025 tax years.H&R Block prices are ultimately determined at the time of print or e-file. Since tax-exempt interest is not subject to income taxes, it is not included in the calculation of adjusted gross income for taxation purposes. Taxable and tax-exempt interest is reported on Form 1099-INT, part of your consolidated tax reporting statement from Fidelity. Even if you do not receive Form 1099-INT from other sources, you must report any taxable interest income on your tax return.

- Tax laws and regulations are complex and subject to change, which can materially impact investment results.

- Original supporting documentation for dependents must be included in the application.

- Notes and bonds issued by Guam, Puerto Rico, and the U.S.

- A $1,200 exemption is available for residents who are blind regardless of their age.

- Previously, other agencies or entities that have subsequently been merged, dissolved, or changed the form of its operations issued obligations with interest payments that would qualify as a deduction.

For example, the interest on United States Treasury bonds issued before March 1, 1941, to the extent that the principal of such bonds exceeds $5,000, is exempt from normal tax but is subject to surtax. See sections 35 and 103, and the regulations thereunder. For the penalty amounts reported in box 2, you may be able to take a deduction in the “adjusted gross income” section of your return.

Small Business

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you. However, some interest you receive may be tax-exempt.

How Is Interest Income Taxed?

The IRS says it’s income, subject to the same ordinary income tax rates as most other money you might receive during the tax year. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. You’ll need to show the amount of any tax-exempt interest you received during the tax year.

Interest Is Taxed At Ordinary Income Tax Rates

If you received more than $1,500 of taxable interest or dividends during the year, you report all of that interest and dividend income on Schedule B attached to your Form 1040. If your earnings didn’t reach that threshold, you don’t need to fill out Schedule B. Instead, you just report tax-exempt interest and taxable interest on lines 2a and 2b of your Form 1040. Specified private activity bond interest appears in Box 8.

Is all interest income taxable?

It might seem like just a small amount, a handful of dollars here and there, but any interest income that you earn during the year is taxable all the same. The IRS says it’s income, subject to the same ordinary income tax rates as most other money you might receive during the tax year.Examples include Federal Intermediate Banks, Farm Home Administration, Federal Savings and Loan Insurance Corporation, and Student Loan Marketing Association . Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes. Box 1 of the 1099-INT reports all taxable interest you receive, such as your earnings from a savings account. Invest assets in tax-deferred accounts, such as a traditional IRA or 401 to put off paying taxes until you withdraw the money in retirement, and you’re presumably in a lower tax bracket. Keep assets in tax-exempt accounts, such as a Roth IRA or a Roth 401. No matter what the investment, you never owe taxes on anything earned in such accounts, as long as you obey the withdrawal rules.

What Is Tax

Consult an attorney or tax professional regarding your specific situation. Interest on bank accounts, money market accounts, certificates of deposit, corporate bonds and deposited insurance dividends – Be aware that certain distributions, commonly referred to as dividends, are actually taxable interest. They include dividends on deposits or on share accounts in cooperative banks, credit unions, domestic building and loan associations, domestic federal savings and loan associations, and mutual savings banks. Paying income taxes is a fact of life. And when the IRS says income, it means all the money you make — both earned, from your work, and unearned, from your investments.

What’s Not Taxable

For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Bank products and services are offered by MetaBank®, N.A.You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. All tax situations are different. Fees apply if you have us file a corrected or amended return. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Tax-exempt interest is interest income that is not subject to federal income tax. In some cases, the amount of tax-exempt interest a taxpayer earns can limit the taxpayer’s qualification for certain other tax breaks.And, a $1,200 exemption is available to disabled individuals who are unable to work, provided they have not reached their 65th birthday. The I&D Tax is then repealed for taxable periods beginning after December 31, 2026. Obligations bought at a discount; bonds bought when interest defaulted or accrued. Box 2 reports interest penalties you’re charged for withdrawing money from an account before the maturity date. Early withdrawal penalties, such as those required for withdrawing money from a CD before its term is over, appear in Box 2.Utah is an example of a state that exempts interest on out-of-state bonds, as long as that state does not impose a tax on bonds issued by Utah. Tax-exempt interest may also be earned in Roth retirement accounts as well as some other tax-advantaged products and accounts. Distributions commonly known as “dividends” on deposit or share accounts in credit unions, cooperative banks, and other banking associations. See the first bullet below for information about an exclusion from income for interest redeemed from certain Series EE and Series I bonds if you meet certain requirements. If the trust has non-transferable shares, the trust itself is subject to tax on the interest and dividends it receives . Interest on notes and bonds from states other than North Carolina should be included onForm D-400 Schedule S, Part A – Additions to Federal Adjusted Gross Income.