Content

- By Business Need

- Benefits Of Accounts Receivable Software

- Sage People

- Software Pricing Tips

- Simplify Payment For Customers

- Compare All Accounts Receivable Software

Unless you keep a track of this reporting, you cannot manage the flow of cash properly. Quickbooks is an accounting software that lets you manage banking-related tasks with its powerful automation tools.For QuickBooks and XERO users, our Premium solution includes an automated sync of customers, invoices, payments and more. We looked at nineteen accounting software companies with specialized products for small businesses before choosing our top five software options. We considered cost, scalability, ease of use, reputation, and accounting features. Scalability was the next most important consideration because as a company grows, its accounting needs grow as well, and transferring financial information to new software can be tedious. Finally, ease of use and collaboration for business owners, employees, and accountants was considered because it’s important for all users to be able to access and review the financials at the same time. Wave is an ideal accounting software platform for a service-based small business that sends simple invoices and doesn’t need to track inventory or run payroll. For many freelancers or service-based businesses, Wave’s free features will cover all of their accounting needs and is the best free software in our review.

By Business Need

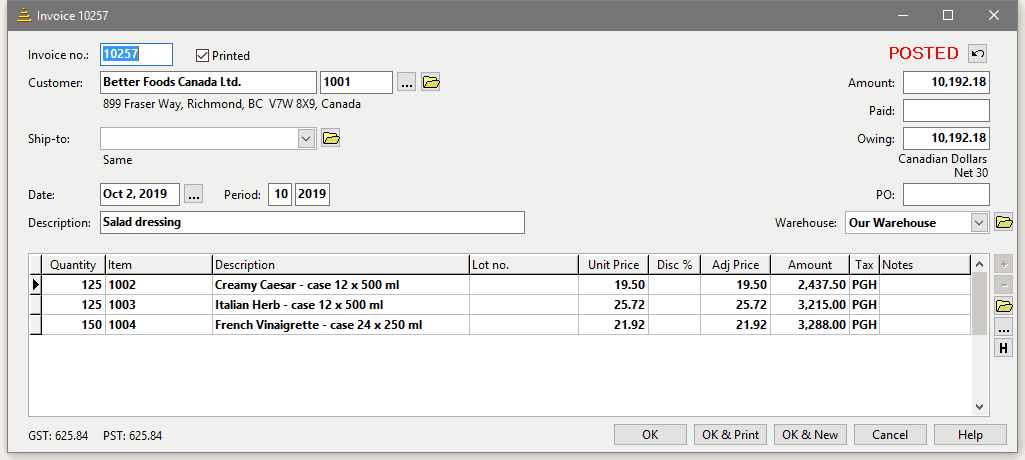

Usually, an accounts receivable software also has an invoicing feature. It automatically generates invoices based on the customer information you have. After the invoice is prepared, it notifies your customers of their due payment. This tool relieves you of manual invoicing tasks and encourages your customers to pay on time. Softledger automates billings and collections and helps you in the timely collection of customer receivables. It has features such as general ledger, financial reporting, and cash management.

Benefits Of Accounts Receivable Software

All this, in the long run, will help your business become more profitable and sustainable. Accounts receivable automation software is especially useful for bringing together the various teams using financial information, for using data to scale up your business and become more profitable. PAIDAPI.COM– Paid is a modern billing automation platform for small and large businesses alike.

- These business will usually have dedicated AR teams whose job is entirely to monitor and track the workflow in your company’s AR processes.

- Accounts receivable automation software will allow you to automate the process of entering the customer statements.

- The team at Bill.com have mastered the art of Invoicing Processing by helping business virtually eliminate all of the traditional bill hassles known by Owners, Managers, and Accountants.

- Streamline accounting, inventory, operations and distribution.

- Locally installed, or on-premise software, will generally be purchased upfront.

- First, an AR software automates simple and repetitive tasks.

ClickNotices is the multifamily industry’s only comprehensive delinquency management platform. Learn how thousands of businesses like yours are using Sage solutions to enhance productivity, save time, and drive revenue growth. Experts forecast that by 2024, 90% of B2C invoices will comprise if e-invoices. With the European standard on invoicing in effect, European public entities are now also required to receive and process e-invoices.

Sage People

While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly. For this reason, many businesses hire bookkeepers or accountants to maintain or review their books.

What is accounts receivable QuickBooks?

Accounts receivable are created when a customer purchases your goods or services but does not pay for them at the time of purchase. … QuickBooks helps you manage accounts receivable by tracking invoices, payments, and identifying your delinquent accounts.This is an essential tool that allows you to record important information from your transactions such as customer name, sales tax, and total amount billed. This software offers customer communication, payment processing, invoicing, and credit and collection tools. The product offers an Essential plan priced at $3,900/year, while Standard and Pro plans are available by quote. Acumatica is another accounts receivable software that keeps track of all the credit or cash your customers owe you. It helps you generate invoices, verify balances, and track commissions. Freshbooks offers advanced accounting features to simplify complex financial management.

Software Pricing Tips

Once you send an invoice, FreshBooks automates the rest of the accounts receivable process. You can set the platform to send automatic late payment reminders at specified intervals and FreshBooks also allows you to customize the message for a personal touch. The above list summarizes pricing for the base plans of most products. An enterprise or professional product, which is priced higher, may include additional features such as custom automation rules, customer success manager, advanced reporting, and scaled data storage. These solutions facilitate both short and long-term accounting needs, including core accounting, financial reporting and budgeting and forecasting.

Simplify Payment For Customers

A great way to understand the compatibility of your business with the software is to use the basic free version and see if the accounting teams are comfortable using the particular software or not. Once you decide to invest in Accounts receivable automation software, before buying the software you need to have a careful understanding of its features. Account Receivable Software is an online tool used by factoring firms for easy account management. However the cost of the goods and/or services rendered would be considered expenses. Esker defines a perfect invoice as one that’s compliant with the PO, customers’ format requirements, delivery method and local regulations. By offering automated invoice delivery via any media or to portals and full compliance in 60+ countries around the world.With an AR system’s reporting tools, you gain access to important business reports to help you determine your business’s health. First, an AR software automates simple and repetitive tasks. You already know how invoicing late notices, account changes, and payment reminders can take a lot of time when done manually. Using an AR software, you can automate these functions and save boatloads of time that you can allot to more productive tasks. There are many different types of accounting software available for small businesses, with varying capabilities and price tags. Generally, the type of industry and number of employees are two factors that can help a small business owner begin to choose the accounting software that is appropriate. For example, a freelancer would not need the same features in accounting software as a restaurant owner.You may not think of it exactly in these terms, but accounts receivable is essentially a record of the short term credit you extend to your customers. Just like a bank making loans, you need to determine who is credit-worthy and who isn’t. You also need a set of processes in place to ensure the recovery of the credit you’ve issued.Sorts products as a function of their overall star rating, normalized for recency and volume of reviews, from highest to lowest. This is the more traditional model and is most common with on-premise applications and with larger businesses. Includes customized onboarding process and account manager with the account. Customer statements won’t be much different than the ones you’re printing now, but the mismatch will be the fact that you don’t have to enter information manually and to double-check whether you’ve updated it. Customer statements are important to you because they fill the gap of reporting to customers their hanging and outstanding obligations.In today’s world where customers tend to have diverse and evolving habits, a business must be able to address this complex consumer behavior by being wherever their customers want to do business. This is why AR systems now have omnichannel collection capabilities to ensure that every payment mode is covered.There are many third-party app integrations available, such as Shopify, Gusto, Stripe, G Suite, and more. A unique feature of FreshBooks is that invoices can be highly stylized and customized for a professional look and feel. FreshBooks is a great tool for budgeting out projects, sending estimates or proposals, and collecting customer payments. Using sorting and filtering capabilities, you can easily identify customers in good standing or with late payments. With increased reporting ease you’ll be able to quickly update yourself with the information you need to make key business decisions. Bill.com is the intelligent business payments platform that delivers financial process efficiency, time savings, and full control.These fees are slightly higher than other accounting software. Additionally, to process an ACH payment, rather than a credit card, Wave charges 1% per transaction with a $1 minimum fee. This is unique to Wave, as the majority of accounting software does not charge a fee for ACH payment processing.Accounts receivables are created when a company lets a buyer purchase their goods or services on credit. An accounts receivable software should be able to make things easier for you and not add to the complication of your accounting tasks. A great AR tool is one that has a user-friendly interface, allowing your team to get used to the system fast. Vendors usually offer a free trial of the software to get you up to speed with its features.Accept payments in various forms, including cash, check, electronic funds transfer or credit card. Some systems include integration with various merchant or payment services such as PayPal. Accept multiple payment methods from customers ; sync received payments directly with your accounting software. Automated collections software to manage customers and track payments across channels. An accounts receivable system with a phone call management tool allows your collectors to easily record and transcribe these phone calls straight from within the platform. It should also allow your clients to access a prerecorded phone menu for self-service purposes, including balance inquiry or talk to a live collection agent. Just like its marketing counterpart, the automated email feature of your AR platform is a powerful way to engage your clients to pay their bills.Accounts receivable software automates the cash flow and funds owed to your business for goods or services provided. These funds are usually owed by your customers for purchases made on credit, meaning they have not been paid for yet by customers. In other words, accounts receivable software manages customer debt collection. The software is likewise efficient in tracking expenses, allowing users to account for all payables. The same goes for invoices as the system lets users know when one has been sent and opened by the receiver. It also sees to it that no invoice slips through the cracks by automatically sending out reminders of overdue payments to clients. And since the platform operates from the cloud, users can access their accounting data anytime, anywhere.Predictive analytics in standalone AR tools can help you determine which customers may pose a higher risk, which will help you avoid problems before they even happen. Otherwise, these tools will require a stronger collections CRM feature for monitoring communications between your business and your customers that owe. Those who are self-employed or have very small businesses may benefit from finding a free accounts receivable software.