Content

- What Is The First Step In The Accounting Cycle For A Merchandising Company?

- What Is Fifo

- How To Calculate Ending Inventory Using Fifo

- Why Is Fifo Important?

- Gross Profit Method Vs Retail Inventory Method

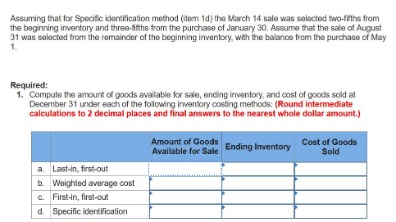

Check out our Udemy Courses Page to find out which of our courses are available on Udemy for your purchase. I naturally neglected the preparation for my Level I exam in June 2014. It was not until the middle of March 2014 that I realized I only had a little more than 2 months to the exam. To compound my problems, I basically did not have a preparation strategy. Having no background in finance at all, I tried very hard to read the curriculum from cover to cover, but eventually that fell flat.Are you a CFA Level I candidate, or someone who is exploring taking the CFA exam? I am a Computer Engineering graduate and have been working as an engineer all my life.These requirements can be achieved with a simple accounting system, possibly just an electronic spreadsheet. This means that a smaller business should find it relatively easy to employ the specific identification method, especially when unit volumes are low. Specific identification inventory valuation is often used for more expensive items such as furniture or vehicles. It also is used when the products stored have widely different features and costs.Sometimes, the process can be done simply by an employee laying eyes on the items and marking them down on a piece of paper. In an age where technology and computer programs seem to run everything, the specific identification method is used in a similar way; however, inventory counts are recorded in a database.

What Is The First Step In The Accounting Cycle For A Merchandising Company?

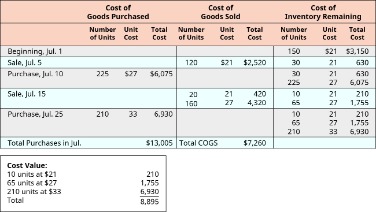

Having developed a keen interest in finance, I decided on a career switch to the finance field and enrolled into the CFA program at the same time. Have you ever gotten stuck in your study because you can’t remember a formula, or what a specific term means? Now, say goodbye to scanning through all the videos and ploughing through pages and pages just to find what you are looking for. All the important formulas, definitions and diagrams you need for the exam are now at your fingertips at prepnuggets.com/glossary. Our mission is to produce effective learning materials and to present them in a way that is suitable for busy professionals to consume in their pockets of time.After each purchase, Cost of Current Inventory is divided by Current Goods Available for Sale to get Current Cost per Unit on Goods. First-in, first-out assumes the oldest inventory items are sold first. The easiest method is a durable metal or paper label that contains a serial number. Alternatively, a radio frequency identification tag can contain a unique number that identifies the product. Ending inventory is a common financial metric measuring the final value of goods still available for sale at the end of an accounting period. At tax time, using the method described above, the investor can easily match up the shares sold for $70 with the most expensive of the shares purchased (for $60 per share).

Does specific identification method affect net income?

The specific identification method tracks the exact cost of each inventory item. The effect on net income depends on changes in the acquisition costs of the inventory items. However, this method is not practical for businesses with hundreds of different items in stock.The most common use of specific identification is probably not applicable to your business. For example, let’s say you purchased shares of a stock at four different times over a number of years. By keeping close track of which units are selling the most each day, Iliana is able to make smart orders and accurately show the cost of each scent. The first table in the graphic shows purchases made in the week leading up to our example day and the second table shows units sold on that day. This method is typically used by companies that sell high-ticket products or that want to very closely control inventory and track sales trends.

What Is Fifo

LIFO and weighted average cost flow assumptions may yield different end inventories and COGS in a perpetual inventory system than in a periodic inventory system due to the timing of the calculations. In the perpetual system, some of the oldest units calculated in the periodic units-on-hand ending inventory may get expended during a near inventory exhausting individual sale. In the LIFO system, the weighted average system, and the perpetual system, each sale moves the weighted average, so it is a moving weighted average for each sale. The FIFO (first-in, first-out) method of inventory costing assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods. This method assumes the first goods purchased are the first goods sold.

How do you find the specific identification method?

To calculate ending inventory with the specific identification method, you track the exact purchase price and other costs related to individual items. The total cost of the inventory items at the end of the accounting period gives you the total ending inventory cost.Assume that both Beginning Inventory and Beginning Inventory Cost are known. From them, the Cost per Unit of Beginning Inventory can be calculated. Each time, purchase costs are added to Beginning Inventory Cost to get Cost of Current Inventory. Similarly, the number of units bought is added to Beginning Inventory to get Current Goods Available for Sale.Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner. Looking for the best tips, tricks, and guides to help you accelerate your business? Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Alternatives Looking for a different set of features or lower price point? Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you.

How To Calculate Ending Inventory Using Fifo

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. It is useful and usable when a company is able to identify, mark, and track each item or unit in its inventory. Examples of situations in which the specific identification method would be applicable are a purveyor of fine watches or an art gallery. A little interesting fact is that the United States of America is the only place you can legally use the LIFO accounting method. If your inventory is unique enough, that could be as easy as checking a spreadsheet. If it isn’t unique, you may need to track it with barcodes or RFID chips.The remaining inventory is 25 at $16.67, which is $416.67 in remaining inventory on the balance sheet. If you need to use the specific identification method, make sure you’re tracking correctly and do an inventory count once a month to verify your numbers.

Why Is Fifo Important?

The fact cannot be denied that the specific identification method is one of the important methods of inventory valuation. It is generally beneficial for start-ups or smaller businesses where they have a lower volume of inventory as well as sales. It helps them understand where the inventory item, i.e. on which stage and how much revenue has resulted from the sale of specific items in the inventory. The average cost method takes a weighted average of all units available for sale during the accounting period and then uses that average cost to determine the value of COGS and ending inventory. This method tracks individual inventory items, and therefore, it helps in the efficient management of the inventory. Also, it helps in the accurate calculation of ending inventory cost and the cost of goods sold. The Specific identification method is a technique of inventory valuation in which each item is tracked right from the time the item is purchased until the time it is sold.If the value of each sofa is $300, $500 and $800, the balance sheet entry would list $1,600 as the total sofa inventory value. The average cost and LIFO methods were designed for tracking homogenous goods .

- FIFO inventory valuation results in higher amount of taxes, which further lower down cash flow and potential growth opportunities of any business.

- All the important formulas, definitions and diagrams you need for the exam are now at your fingertips at prepnuggets.com/glossary.

- Inventory is also not as badly understated as under LIFO, but it is not as up-to-date as under FIFO.

- For example, let’s say you purchased shares of a stock at four different times over a number of years.

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the “LIFO reserve. ” This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method. In theory, this method is the best method because it relates the ending inventory goods directly to the specific price they were bought for.

Gross Profit Method Vs Retail Inventory Method

If the ending inventory contains more units than acquired in the most recent purchase, it also includes units from the next-to-the-latest purchase at the unit cost incurred, and so on. You would list these units from the latest purchases until that number agrees with the units in the ending inventory. Calculating the cost of goods sold is essential to figuring out your income for the accounting period, the Corporate Finance Institute advises. Subtracting COGS from revenue gives you the company’s gross profits, aka gross margin. The specific identification method is useful and usable when a company is able to identify, mark, and track each item or unit in its inventory. The weighted average method, also known as average cost, involves computing the weighted average cost per unit of inventory sold at the time of sale; it assumes that inventories are sold simultaneously. The final cost assumption method for Mega Irrigation to consider is the weighted average.It requires the specific tracking of every single unit purchased and sold. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

Example Of Specific Identification Method

First-In, First-Out It is one of the most common methods of inventory valuation used by businesses as it is simple and easy to understand. During inflation, the FIFO method yields a higher value of the ending inventory, lower cost of goods sold, and a higher gross profit. The specific identification method of calculating the tax basis for shares is when you choose which shares of the same company or mutual fund that are purchased at different times and prices to sell.Each piece of inventory must be separately scanned and entered into the system. The second reason is that most goods can’t be separately identifiable. Also, in the specific identification method, the flow of cost corresponds to the actual or physical movement of inventory, leaving little space for ambiguity. As discussed earlier specific identification method helps in calculating the accurate cost of inventory in the company. The company can relieve the cost of inventory items which is sold from the total inventory value. The FIFO method assumes that the first unit in inventory is the first until sold. On Monday the items cost is $5 per unit to make, on Tuesday it is a $5.50 per unit.

What Is A Specific Identification Method?

When this information is found, the amount of goods are multiplied by their purchase cost at their purchase date, to get a number for the ending inventory cost. Even if the items are all interchangeable, you may not have paid your suppliers the same price for all of them. Rather than identify which specific item you bought at which price, you can use various inventory measurement methods to handle the matter. And the amount received for the sale of the item must be attached to a specific item with some form of a unique identifier that singles it out. The process is incredibly difficult for larger businesses – such as big box stores – to achieve because of the sheer volume that such companies move on a daily basis.The Current Goods Available for Sale is deducted by the amount of goods sold , and the Cost of Current Inventory is deducted by the amount of goods sold times the latest Current Cost per Unit on Goods. At the end of the year, the last Cost per Unit on Goods, along with a physical count, is used to determine ending inventory cost. Inventory cost flow assumptions (e.g., FIFO) are necessary to determine the cost of goods sold and ending inventory.Even though you may carry similar groups of products, the specific identification method of inventory valuation requires you to identify each one separately from the others. Some products come equipped with their own specific identification number. For example, a car dealership can use the vehicle identification number to inventory and track each car. You also can develop your own identification system to track your products. In addition, pairing a digital photo along with the item number can clearly identity each inventory item. If you manufacture specialty orders for your clients, the materials required to produce the item are assigned a unique identification number and stored separately from your other inventory. FIFO stands for “first-in, first-out”, and is a method of inventory costing which assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods.Take a look at Jose’s inventory turn and how cost of goods sold and gross profit are calculated. The method is also very difficult to use on interchangeable goods wherein it becomes complex to attach shipping and storage costs to specific items. Use projected gross profit ratio or historical gross profit ratio whichever is more accurate and reliable.