December 15, 2021 by Dick RiceSome owner-operators and small business owners don’t know what can be written off and what can’t. Needs some questions answered about how you can get same day funding as an owner-operator? We’ve got all the facts and tips you need t... Read more

December 15, 2021 by Dick RiceIn addition, accumulating a large amount of cash, such as $10,000 or more, will force the bank or credit union to report it to the federal government directly. This threshold is a part of the Bank Secrecy Act passed by Congress. Read more

December 14, 2021 by Dick RiceShe is a graduate of Washington University in St. Louis. Instead of facing this uncertainty each year, you should update your W-4 when you experience a major personal life change or have a change in income. This is a friendly notice. Read more

December 14, 2021 by Dick RiceThe zones are operated as public utilities by states, port authorities, other political groups, or corporations charted by the state. SciTechsperience is a paid internship program that connects college students in science, technology, engineering and... Read more

December 14, 2021 by Dick RiceEstate sales are a smart place to shop for secondhand fine china with intricate details, such as a filigree pattern or gold trim, at a reasonable price, Latham suggests. Do a quick on-the-spot inspection to check for chips and scratches before. Read more

December 14, 2021 by Dick RiceYou’ll need to do this whether you’re hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you. Read more

December 13, 2021 by Dick RiceForbes Advisor has reviewed six online tax platforms to identify the best platforms for people who are self-employed. We analyzed how much it would cost to file, expert assistance options and customer service. When choosing online tax software, go wi... Read more

December 13, 2021 by Dick RiceIf you file electronically with a tax software program, it will automatically direct you to Schedule C based on your answers to certain questions. Beginning with the 2020 tax year, the 1099-MISC is no longer used for reporting non-employee compensati... Read more

December 13, 2021 by Dick RiceThe IRS imposes an underpayment penalty if you don't set aside enough to satisfy your federal tax bill. While it’s possible to escape the penalty by withholding at least 90 percent of your current year’s tax bill, the closer to 100. Read more

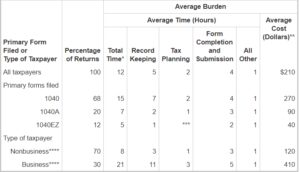

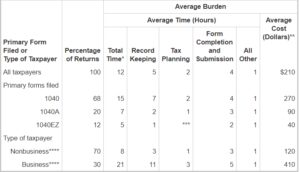

December 10, 2021 by Dick RiceThere is a total row that calculates the sum of columns a, c and d. Line 6 (columns A, B and/or C) calculates the sum of lines 2, 3g, 4a, 4b and 5. It also calculates the total of columns A,. Read more